Because the deadline for the 2022 tax submitting season nears, the IRS faces scrutiny for its backlog of returns, inaccessible taxpayer service, and delays in issuing sure refunds. As of January 28th, the Inside Income Service (IRS) had 23.7 million returns awaiting action, in comparison with a typical backlog at that time of roughly 1 million returns. IRS Commissioner Charles Rettig not too long ago testified the IRS will atone for the return backlog by the tip of the yr by creating surge groups and planning to hire an additional 10,000 workers, however that may do little to alleviate the ache of this yr’s submitting season ending in lower than a month.

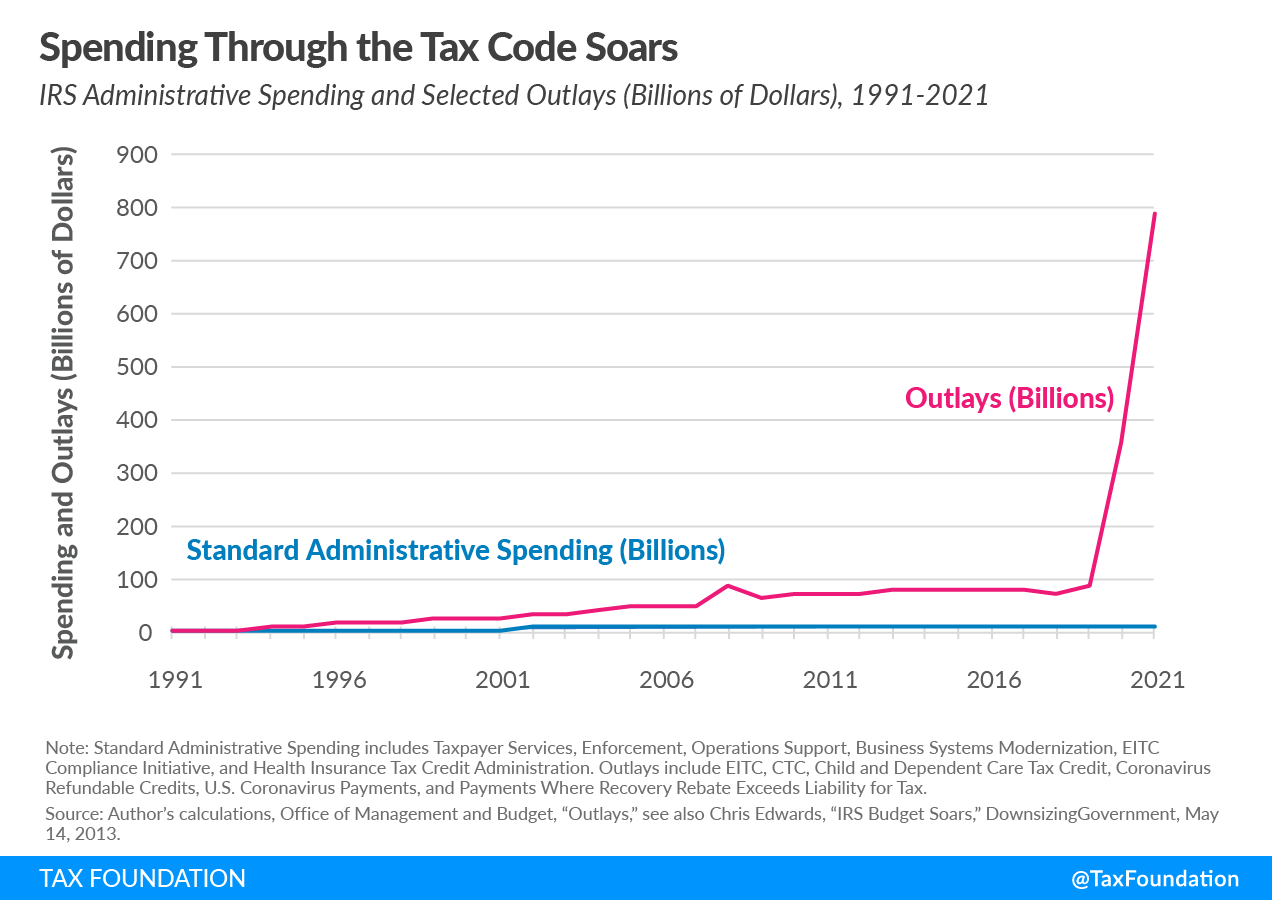

In some ways the present chaos is the fruits of a problematic pattern in fiscal coverage. For the previous few many years, policymakers have more and more relied on the tax code to ship main social spending initiatives, including advantages administration to the IRS’s regular obligations as a income assortment company. On the identical time, IRS capability has not expanded sufficient to match its main new obligations. In the long run, probably the most secure resolution is to maneuver social spending out of the tax code and let the IRS focus its assets on income assortment.

In his 1996 State of the Union Deal with, Invoice Clinton famously stated, “The era of big government is over.” However policymakers didn’t simply abandon their social and welfare coverage targets. The complete context of his quote: “…the period of massive authorities is over. However we can not return to the time when residents had been left to fend for themselves.”

Politicians had been in a tough spot: they’d social coverage targets, taxes had been unpopular (simply ask former president George H. W. Bush), and the political atmosphere was unfriendly to extra authorities spending. The obvious resolution was to show social coverage into tax cuts. By creating new tax credit in lieu of conventional welfare applications, expansions of the social security internet could possibly be framed as tax cuts.

The Taxpayer Relief Act of 1997 included a number of reforms to the tax code, probably the most outstanding being the creation of the Baby Tax Credit score (or CTC). The CTC was partly a repair to higher alter the tax code for family dimension, however help for American households was the core motivation for its creation. Over the previous 20 years, policymakers have made the CTC extra beneficiant by growing its dimension and refundability. And the CTC is just one of many tax credit added to the IRS’s duty together with well being care (e.g., the Inexpensive Care Act’s Premium Tax Credit score), training, housing, power, and the atmosphere.

Over the identical approximate interval, the IRS has confronted important political warmth, though not all the time unjustifiably. In order the obligations of the IRS grew, the political will to lift its finances weakened. As is commonly cited, from 2011 to 2020, the IRS’s finances declined by roughly 20 % after adjusting for inflation. However refundable tax credit (funds the IRS makes when the worth of a credit score exceeds tax legal responsibility) have soared.

Enter the pandemic.

All three main rounds of aid laws (the CARES Act in March 2020, the Consolidated Appropriations Act in December 2020, and the American Rescue Plan in March 2021) relied closely on the tax system to distribute pandemic aid. For instance, three rounds of financial influence funds had been administered as tax credit; the CTC was expanded and briefly transformed right into a month-to-month fee; the Earned Earnings Tax Credit score (EITC) used a look-back formulation; and the primary $10,200 in unemployment compensation in 2020 was excluded for sure taxpayers.

The IRS acquired further funding to manage the pandemic aid applications, however the aid applications stretched properly past the IRS’s capability. Whereas the IRS experienced a reduction of in-person meetings from 752,000 in 2019 to 374,000 in 2021, it was greater than offset by an uptick in telephone calls—the company acquired 195 million calls within the 2021 submitting season, relative to simply 36 million within the 2019 submitting season. (In reality, pissed off taxpayers have even referred to as the Tax Basis for assist as a result of nobody on the IRS is accessible to reply their questions.)

Low-income earners are sometimes impacted probably the most by poor IRS service. For instance, low-income households incomes lower than $25,000 were least likely to listen to about latest modifications to the CTC and should navigate these modifications with out one-on-one IRS help. Many of those households could not recurrently file tax returns, making it even tougher for them to assert advantages administered by means of the tax code.

The stretched IRS is a product of the structural option to put it accountable for delivering social advantages. Erin Collins, the IRS’s Taxpayer Advocate, said the IRS’s “phone service was the worst it has ever been” in 2021. And as Collins famous in her Annual Report to Congress this yr:

“Every monetary aid program consumed appreciable IRS assets to manage, together with general planning, data know-how (IT) programming, implementation, public communications, and responding to taxpayers’ questions and account points. To handle these wants, the IRS needed to reallocate assets from its core tax administration obligations.”

Within the quick time period, the answer contains ramping up non permanent hires and pulling again the obstacles that gradual hiring. Now, one may counsel ramping up the IRS’s capability dramatically and completely so it may possibly successfully function each a advantages company and a tax assortment company in the long run. However such strategy has a minimum of two points: spending businesses, somewhat than the IRS, must be accountable for administering advantages topic to the appropriations course of, and the IRS’s standing as a political soccer makes its finances much less dependable. Even within the quick time period, ramping up capability will probably be difficult because the IRS is already dealing with hiring shortfalls for open roles.

Larger image, the present disaster ought to draw the necessity for elementary tax reform into clearer focus. Simplifying and lowering social advantages within the tax code would make it simpler for the IRS to give attention to its major mission: gathering income for the federal authorities.

For instance, changing the Baby Tax Credit score with a month-to-month baby allowance administered by the Social Safety Administration would let the IRS do extra with the finances it at the moment has. Relieved of the burden of being each America’s tax assortment company and social profit distribution company, the IRS might make much-needed long-term investments in data know-how and effectivity.

Finally, shifting social coverage out of the tax code is sensible from a tax coverage perspective, a advantages coverage perspective, and a tax administration perspective.