Latest discussions of a proposed wealth tax for the USA have included little details about developments in wealth taxation amongst different developed nations. Nevertheless, these developments and the present state of wealth taxes in OECD international locations can present context for U.S. proposals.

The OECD maintains detailed tax revenue statistics for its 38 member international locations. The information contains revenues from taxes on the web wealth of people.

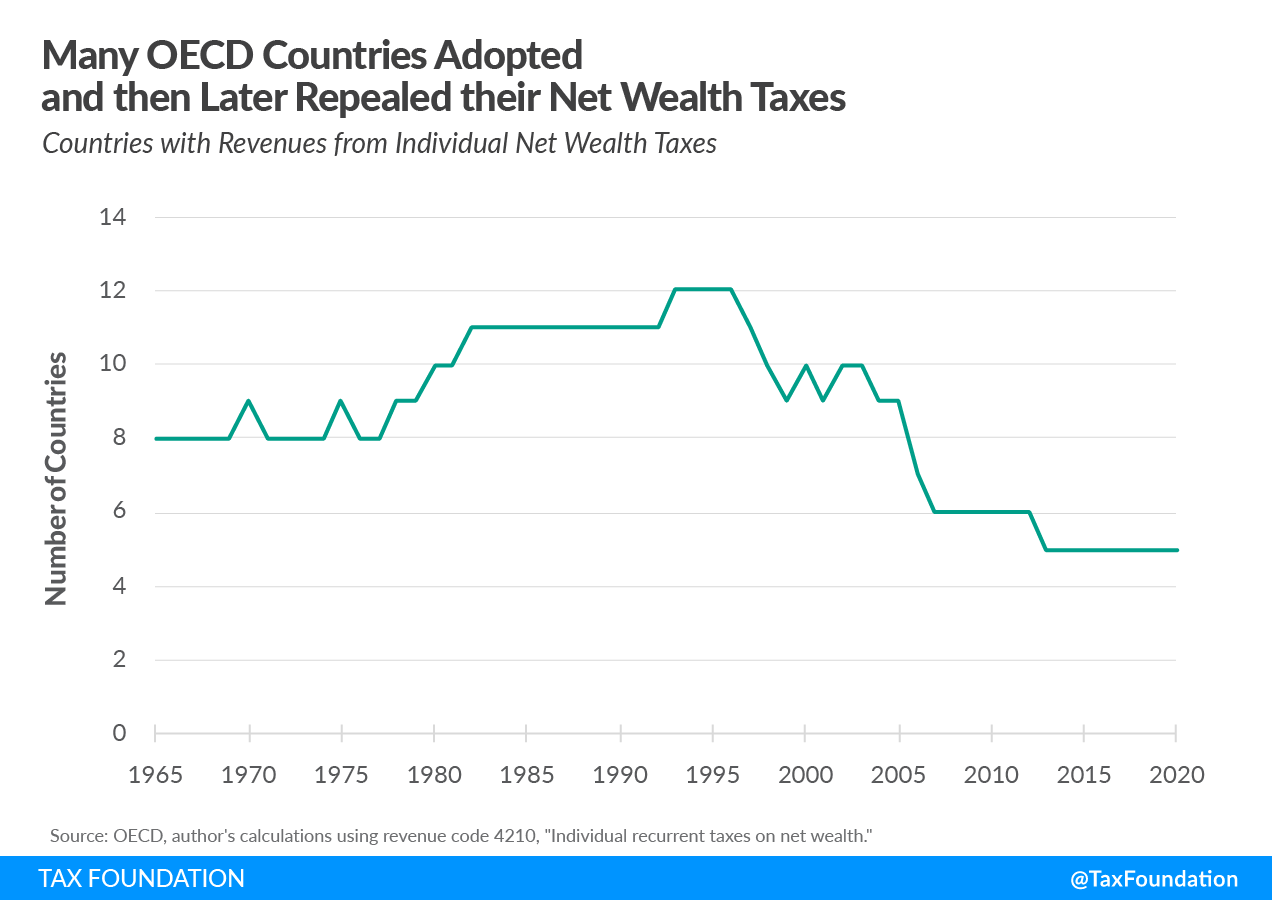

In response to these information, the variety of present OECD members which have collected income from internet wealth taxes has grown from eight in 1965 to a peak of 12 in 1996 to only 5 in 2020.

Within the OECD information, the international locations that collected revenues from internet wealth taxes on people in 2020 are Colombia, France, Norway, Spain, and Switzerland. Revenues from internet wealth taxes made up 5.12 % of revenues in Switzerland in 2020 however simply 0.19 % of revenues in France. Amongst these 5 OECD international locations gathering revenues from internet wealth taxes, revenues made up simply 1.5 % of complete revenues on common in 2020.

France’s internet wealth tax was principally repealed in 2018 and now solely applies to actual property. At its peak in 2014, income from the French internet wealth tax made up 0.55 % of complete French income. Colombia is at present working a brief 1 % tax on internet wealth for tax years 2019 by 2021.

An OECD report about wealth taxes argues that these taxes can hurt risk-taking and entrepreneurship, harming innovation and impacting long-term development. The report additionally suggests {that a} internet wealth tax may spur funding and risk-taking. Primarily, the argument is that as a result of a wealth tax would erode the after-tax return for an entrepreneur, that entrepreneur may interact in even riskier ventures to maximise a possible return. Nevertheless, a wealth tax could be a very poor solution to encourage risk-taking.

The income information from the OECD doesn’t completely match the coverage modifications made by international locations. As an illustration, Austria successfully repealed its internet wealth tax in 1994, however revenues from the tax continued to trickle in till 2000. The OECD additionally carried out a survey of nations relating to their internet wealth taxes and the pattern for gathering revenues from internet wealth taxes is just like the survey responses.

| Nation | Fee | Base |

|---|---|---|

| Colombia | 1% | Internet wealth in extra of COP 5 billion ($1.3 million). |

| France | Charges vary from 0.5% to 1.5% | Private internet actual property property exceeding EUR 1.3 million. |

| Norway | 0.7percenton the municipality degree and 0.25percenton the nationwide degree | Honest market worth of property minus debt. Tax applies to worth of wealth above NOK1.5 million ($180,000) for single/not married taxpayers and NOK 3 million ($360,000 for married {couples}. |

| Spain | Charges vary from 0.2percentto three.5% | Could differ relying on the area, however typically worth of property minus worth of liabilities. Areas have autonomy in setting the exemption quantity. Extremadura has a high charge of three.75%. Madrid gives a full exemption. |

| Switzerland | Charges vary from 0.05% to 4.5% relying on the canton and metropolis. | Gross property (at truthful market worth) minus money owed. |

|

Supply: PWC, Worldwide Tax Summaries |

||

Some international locations have distinctive exclusions to their wealth taxes. In Spain, the online wealth tax successfully solely applies to taxpayers who don’t reside in Madrid, as a result of the town gives 100 percent relief from the tax. In 2020, as a part of tax aid throughout the pandemic, Norway quickly postponed funds of the wealth tax for people whose internet wealth included companies that have been operating losses.

Through the years, international locations have repealed their internet wealth taxes for numerous causes, however financial affect is included in these causes. French Finance Minister Bruno LeMaire has made it clear that the partial repeal of the wealth tax in France was a part of a reform package deal designed to “entice extra international funding.” The French reform package deal additionally included a deliberate discount within the company tax charge which has been applied over numerous years.

The teachings from different international locations’ experiences with wealth taxes ought to inform policymakers within the U.S. as they contemplate such a proposal. With so many international locations having adopted after which abandon a wealth tax, maybe the U.S. ought to keep away from adopting one within the first place.

Notice: This weblog, initially revealed in 2019, has been up to date to mirror more moderen information on the revenues from wealth taxes.