A common argument for rising company taxes is that collections as a share of gross home product (GDP) fell after the speed was diminished to 21 % as a part of the Tax Cuts and Jobs Act (TCJA) in 2017. However that argument is incomplete.

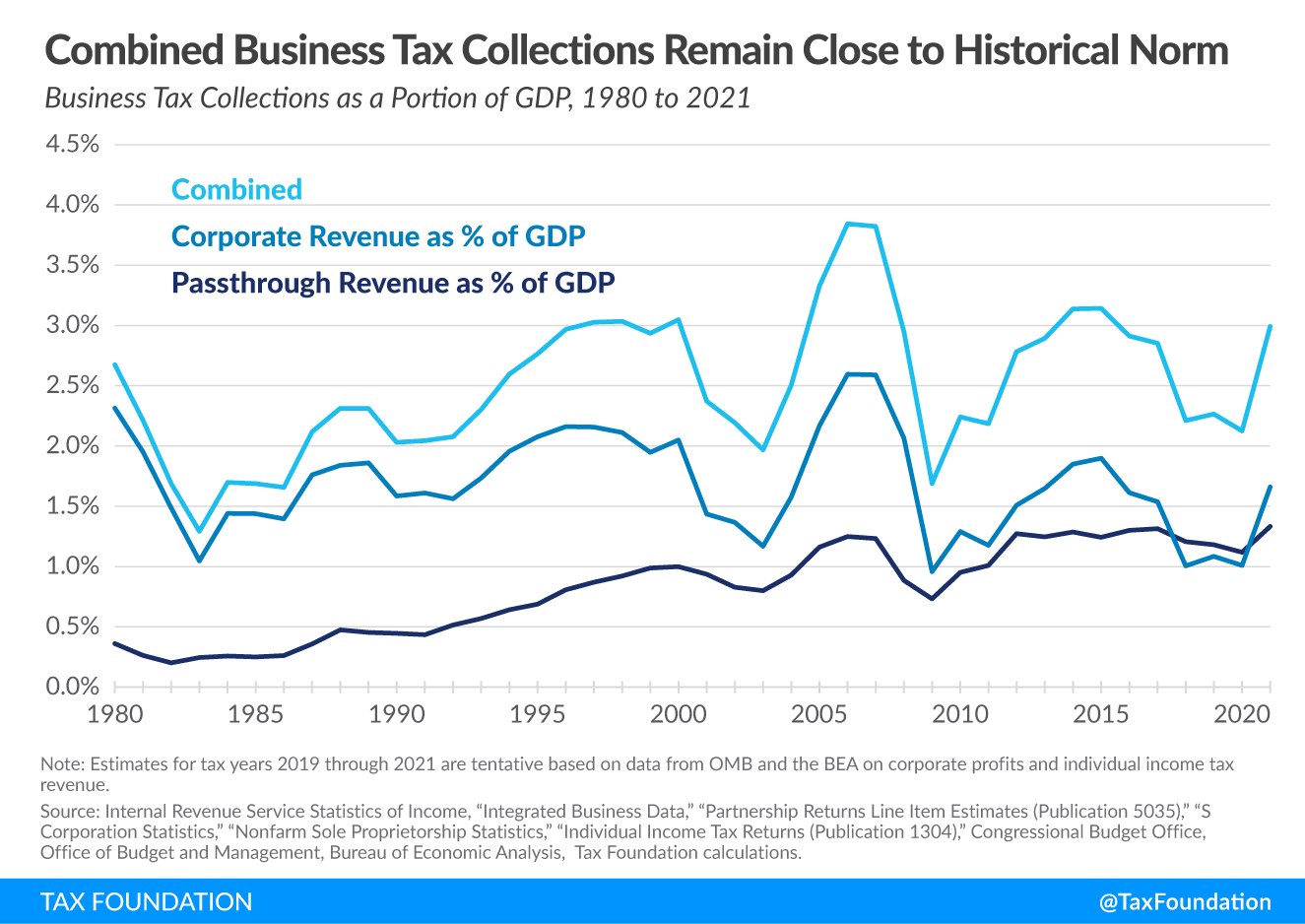

We estimate that when accounting for the U.S. pass-through enterprise sector and a latest upturn in company tax collections, enterprise tax collections will attain about 3.0 % of GDP in 2021, which is properly throughout the historic norm for enterprise tax collections and the very best since 2015. As the bottom broadeners enacted within the TCJA start to take impact subsequent 12 months and the financial restoration continues, enterprise tax income might climb additional.

First, company tax income recovered to a nominal all-time excessive in 2021 and 1.7 percent of GDP, which is about common for the 20 years previous to TCJA. Second, the U.S. has a big pass-through enterprise sector the place taxes are collected by the person earnings tax system, and people revenues have additionally rebounded this 12 months.

Utilizing Inside Income Service (IRS) information on earnings earned by pass-through companies (i.e., sole proprietorships, partnerships, and S companies) and the typical tax fee on particular person earnings, we are able to calculate a conservative measure of pass-through enterprise tax collections and examine it to company tax collections over time (see Determine 1).

Move-through enterprise tax collections have grown considerably over the past 40 years, from about 0.5 % of GDP or much less within the Nineteen Eighties to 1.3 % this 12 months and on common over the past 10 years. This displays the expansion within the variety of pass-through companies and enterprise earnings earned by pass-throughs since 1980.

Combining company and pass-through enterprise tax collections, whole enterprise tax collections as a share of GDP rose from a mean of two.3 % within the Nineteen Eighties and Nineteen Nineties to a mean of two.8 % from 2000 to 2017. Complete enterprise tax collections averaged about 2.5 % of GDP from 1980 to 2017.

The TCJA diminished enterprise tax income from about 2.9 % of GDP in 2017 to about 2.2 % in 2018, partially as a result of regulation’s quick deductions for enterprise funding (which have a tendency to scale back income extra within the first few years). Tax collections fell additional in 2020, as earnings dropped throughout the pandemic. Nonetheless, because the economic system and earnings rebounded this 12 months, mixed enterprise tax collections rose to almost 3.0 % of GDP—almost reaching the latest highs set in 2014 and 2015 and exceeding the 42-year common of two.5 % going again to 1980.

If the economic system continues to enhance and earnings develop, enterprise tax collections might rise additional. As well as, the TCJA included a number of base broadeners and different tax will increase which might be scheduled to happen over the subsequent few years, together with a tighter limitation on internet curiosity expense and amortization of R&D prices that begins subsequent 12 months and the phaseout of bonus depreciation starting in 2023. Alternatively, a few of this 12 months’s improve in tax income may be temporary as companies time earnings and bills forward of anticipated tax will increase.

Our estimates might understate precise pass-through enterprise tax collections since 1980, and by extension, understate whole enterprise tax collections. We calculated the share of particular person earnings taxes paid by pass-through companies by utilizing pass-through internet earnings information from the IRS and making use of the typical efficient earnings tax fee on particular person earnings in every year to pass-through earnings. Nonetheless, the typical tax fee confronted by pass-through companies tends to be greater than the general common particular person earnings tax fee. For instance, the typical particular person earnings tax fee in 2011 was about 12.5 %, however in response to a extra detailed analysis, the efficient pass-through agency tax fee was 19 % that 12 months.

When trying on the tax burden on companies over time, it is very important present a whole image by accounting for the several types of companies within the U.S. and the timing results of the 2017 tax regulation. Doing so offers vital context on current tax burdens and for contemplating the influence of elevating taxes on companies and pass-through companies.

Was this web page useful to you?

Thank You!

The Tax Basis works arduous to offer insightful tax coverage evaluation. Our work is dependent upon assist from members of the general public such as you. Would you think about contributing to our work?

Contribute to the Tax Foundation

Tell us how we are able to higher serve you!

We work arduous to make our evaluation as helpful as attainable. Would you think about telling us extra about how we are able to do higher?