The Tax Cuts and Jobs Act (TCJA) of 2017 made a number of adjustments to the U.S. tax system to reinforce competitiveness and discourage revenue shifting to low-tax jurisdictions by U.S. multinationals. Amongst them have been a brand new 10 p.c minimal tax on firms with important cross-border transactions (BEAT) and new tax charges on deemed intangible earnings (GILTI and FDII). International earnings paid to U.S. dad and mom as dividends have been totally exempt from U.S. taxation, transferring the U.S. tax system nearer to “territorial” tax therapy reasonably than worldwide. Lastly, the highest marginal company tax price was diminished from 35 p.c to 21 p.c.

Altogether, policymakers anticipated the adjustments to considerably impression capital flows throughout borders. Collectively, the adjustments would cut back incentives to put money into low-tax jurisdictions, because the tax hole between these jurisdictions and better tax international locations would shrink, and doubtlessly shift a few of this funding overseas to the U.S.

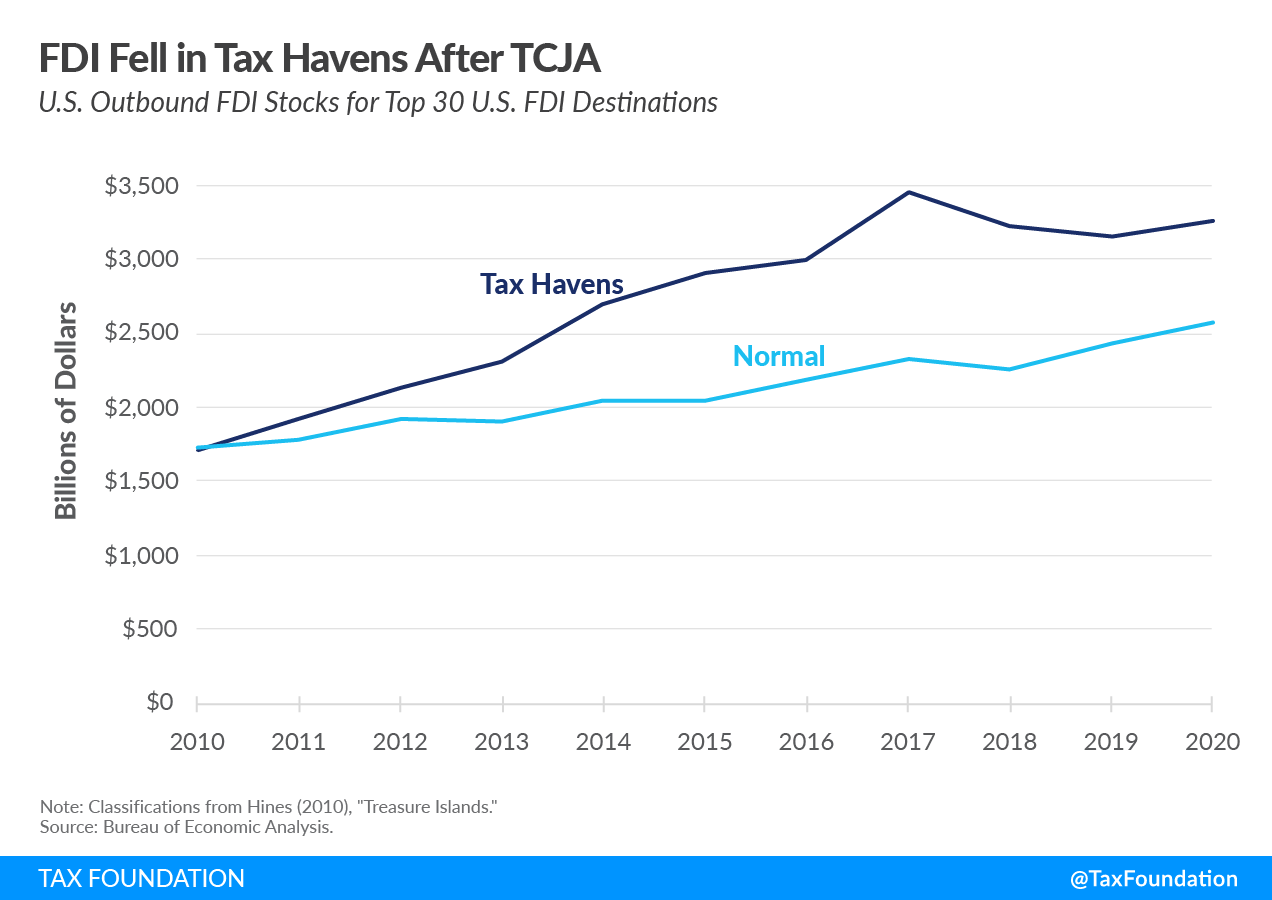

When outbound overseas direct funding (FDI), funding that flows from the U.S. to different international locations, we are able to see the TCJA seems to have had an impression on the place firms are investing. The next chart exhibits tendencies in FDI shares for the highest 30 locations of U.S. FDI. Nations are labeled as “tax havens” primarily based on research of FDI shares achieved by economist James Hines.

Following the TCJA, outbound U.S. FDI shares fell by $192 billion within the tax havens and rose by $251 billion within the “regular,” or high-tax, international locations. The “tax havens” group is comprised of 10 international locations or territories, together with Eire, Bermuda, Switzerland, and the Cayman Islands. This development displays adjustments to revenue shifting incentives following the TCJA, as analysis has discovered that corporations affected by GILTI were less likely to invest in low-tax jurisdictions.

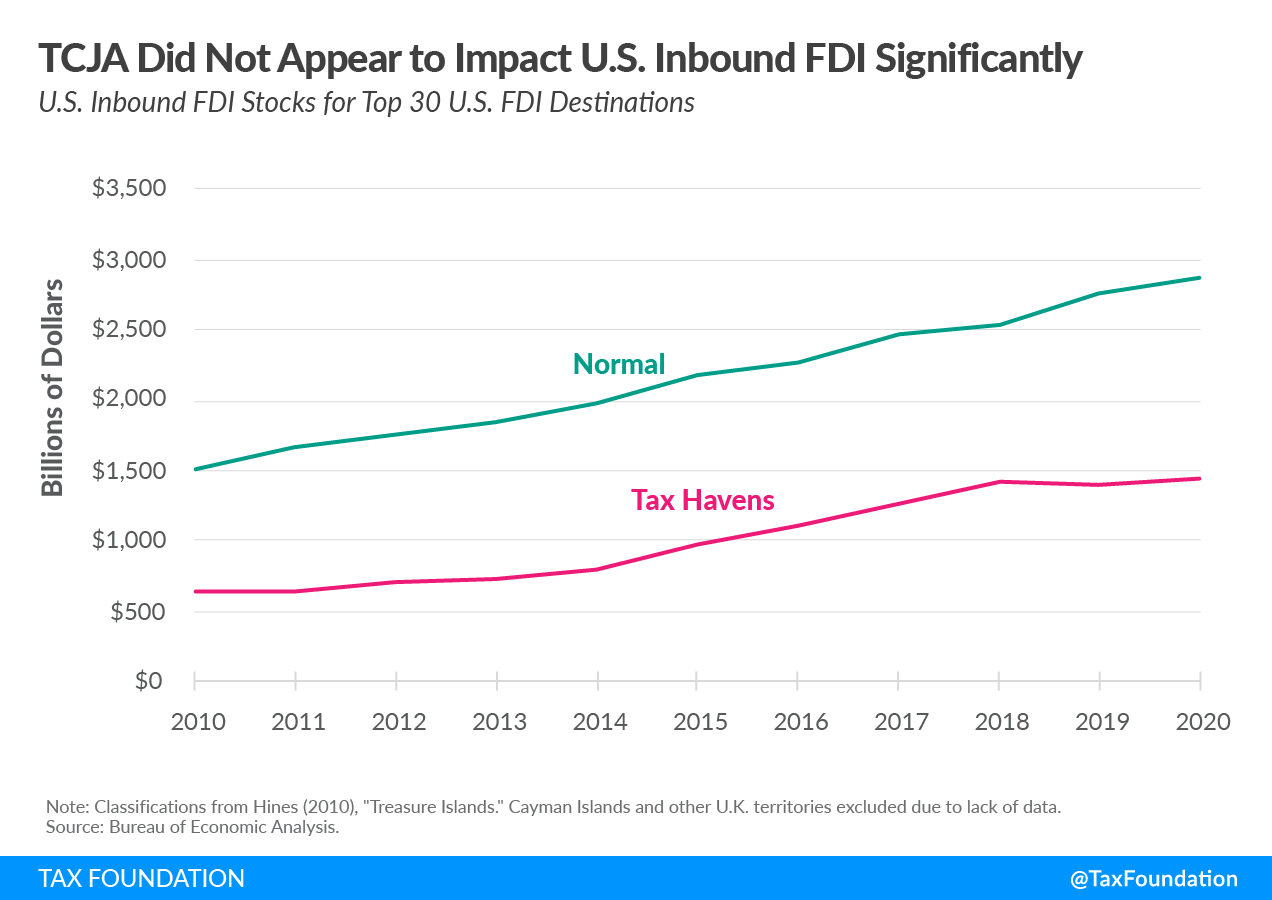

When U.S. inbound FDI throughout the identical set of nations, funding that flows from overseas international locations to the U.S., the TCJA doesn’t seem to have prompted a lot of a break within the tendencies. Inbound U.S. FDI continued to develop at an analogous tempo from high-tax jurisdictions, whereas inbound U.S. from the tax havens continued to develop however at a slower price than it had from 2014 to 2018. Analysis has discovered the continued upward development in inbound FDI was extra possible due to macroeconomic factors aside from the TCJA.

General, the information exhibits outbound FDI shifted from low-tax to different jurisdictions, whereas inbound FDI remained largely unchanged. However as famous within the first and second of our FDI weblog put up collection, elevated overseas exercise needn’t essentially come on the expense of the U.S. workforce and manufacturing trade. U.S. funding in different international locations usually generates advantages for the U.S. and helps strengthen provide chains, and policymakers ought to hold this in thoughts when making an attempt to boost taxes on cross-border funding.