Two main provisions within the federal tax code have been restricted because the Tax Cuts and Jobs Act (TCJA) of 2017: the state and native tax (SALT) deduction and the house mortgage curiosity deduction (MID). Limiting the 2 provisions helped broaden the tax base, offsetting tax income loss from diminished tax charges. The restrictions are slated to run out on the finish of 2025, however policymakers ought to contemplate extending them together with the decrease tax charges.

Taxpayers typically have two choices for revenue tax deductions, which cut back a taxpayer’s taxable revenue: a regular deduction, which is a set deduction quantity set by the federal government ($12,550 for single filers and $25,100 for joint filers in 2021), or itemized deductions, which permit people to subtract designated bills from their taxable revenue in lieu of the usual deduction.

Amongst itemized deductions are the MID, which grants owners the flexibility to deduct mortgage curiosity paid on both their first or second residence. The TCJA restricted the curiosity deduction to the primary $750,000 in principal worth, down from $1 million. One other itemized deduction is the SALT deduction, which grants people the flexibility to deduct state and native taxes towards their federal taxable revenue. The TCJA restricted the SALT deduction to $10,000.

Whereas the deductibility of mortgage curiosity strikes the tax therapy of residential actual property nearer to a consumption tax, there are nonetheless critiques of the MID. Excessive-income taxpayers usually tend to itemize their returns and are sometimes the primary beneficiaries of this deduction. The true worth of the MID additionally will increase with the worth of the house, making the advantages much more concentrated amongst rich people.

Elevated demand spurred by the MID can even result in elevated housing prices, primarily amongst taxpayers who itemize, making the housing market much less accessible extra broadly. Critics of the change steered it may end in much less mortgage participation, harm the center class, and cut back the homeownership price. Nevertheless, we discover little proof supporting these claims. After 2025, MID claims could improve as TCJA’s limitation expires.

The SALT deduction is just like the MID in that it’s one other itemized deduction restricted by the TCJA. Previous to the TCJA, people may deduct a limiteless quantity of state and native revenue or gross sales taxes, actual property taxes, and private property taxes towards their federal taxable revenue. Publish-TCJA, the SALT deduction is capped at $10,000 for revenue, gross sales, and property taxes (except they have been associated to enterprise exercise). The cap made the tax code extra progressive by broadening the tax base, and it helped partially fund reductions in statutory tax charges. Repeal of the SALT deduction cap would be more regressive than the entirety of the TCJA and provide a $31,000 tax cut for the top 1 percent of earners.

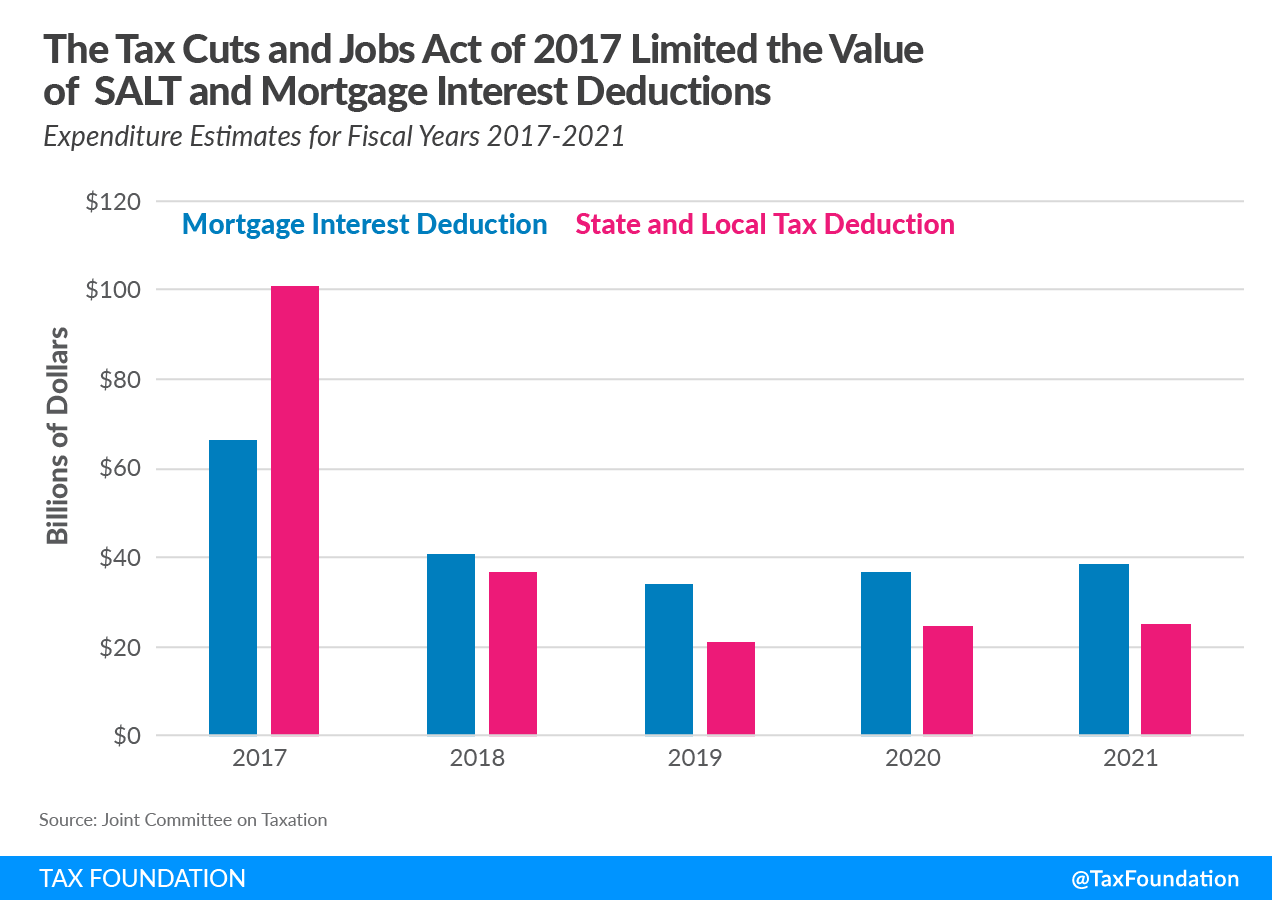

Given the adjustments to the MID and SALT deductions within the TCJA, one would anticipate a large lower in these tax expenditures for fiscal years after the passage of the invoice. Tax expenditure estimates from the Joint Committee on Taxation (JCT) certainly present that: estimated claims for the MID fell from $66.4 billion in 2017 to $38.7 billion in 2021 and for the SALT deduction, from $100.9 billion in 2017 to $25.2 billion in 2021. Slightly than making these limitations extra beneficiant or repealing them early, policymakers ought to contemplate protecting these limitations in place.

Was this web page useful to you?

Thank You!

The Tax Basis works laborious to offer insightful tax coverage evaluation. Our work will depend on assist from members of the general public such as you. Would you contemplate contributing to our work?

Contribute to the Tax Foundation

Tell us how we will higher serve you!

We work laborious to make our evaluation as helpful as doable. Would you contemplate telling us extra about how we will do higher?