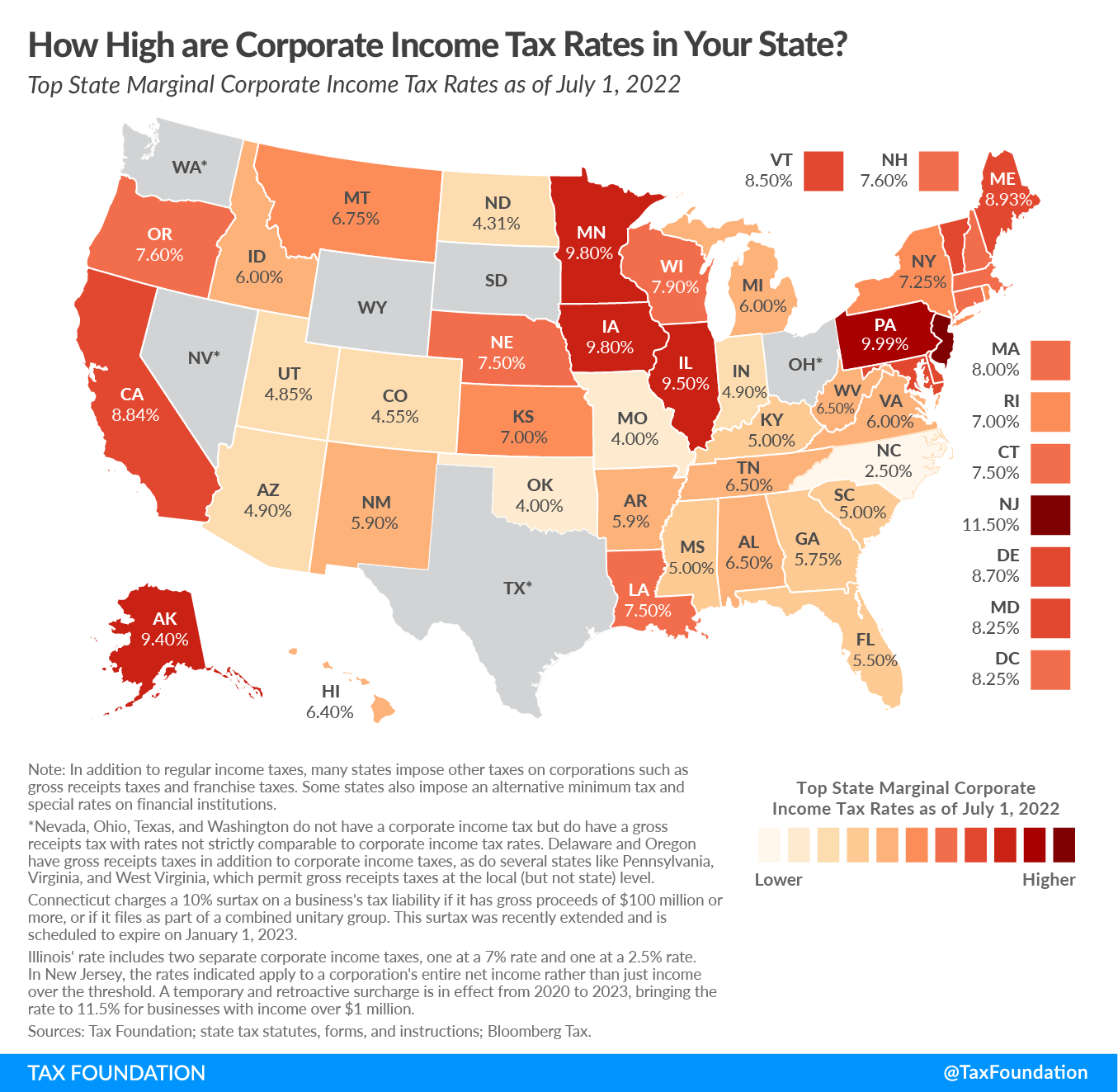

Over the previous decade, policymakers from each events in Harrisburg have proposed decreasing Pennsylvania’s 9.99 p.c company web revenue tax (CNIT) price however couldn’t agree on an strategy—till now. With enactment of HB 1342 as a part of the 2022-2023 state price range, lawmakers lastly succeeded in slicing what had been the second highest state company tax price within the nation.

Starting January 1, 2023, the Pennsylvania company web revenue tax price will lower 1 proportion level to eight.99 p.c. Annually thereafter the speed will lower 0.5 proportion factors till it reaches 4.99 p.c in the beginning of 2031. Moreover, the legislation features a provision that can improve the quantity of capital funding pass-through enterprise house owners can deduct on their particular person revenue tax returns the yr the investments have been made. The laws leaves a couple of issues to be desired, however general, Pennsylvanians will probably be effectively served by the reforms the legislation units in movement.

In June, the Tax Basis testified earlier than a committee of the Pennsylvania legislature concerning how structural tax reforms may benefit Pennsylvanians navigating the challenges of inflation. A number of of the suggestions, together with slicing the company web revenue tax price and rising the quantity of capital funding that may very well be instantly expensed, have been included within the remaining model of HB 1342.

In contrast to insurance policies that present near-term monetary aid (like tax holidays, direct money transfers, or rebates), these structural tax reforms might help the state’s financial system reply to inflationary demand. Furthermore, the reforms will proceed to yield financial advantages after the inflationary interval has waned.

The eventual depth of the CNIT minimize in HB 1342 exceeded these of Home and Senate payments—7.99 p.c and 5.99 p.c, respectively—that handed of their originating chambers earlier this yr. Governor Tom Wolfe (D) had proposed a 4.99 p.c CNIT price that might have been largely offset by an aggressive quasi-combined reporting construction. It will have added complexity and uncertainty to the Commonwealth’s tax construction whereas limiting the good thing about the speed discount. The ultimate model of HB 1342 included the governor’s price however excluded his addback plan. When totally carried out, the brand new 4.99 p.c price may very well be the seventh lowest company price within the nation.

Till passage of HB 1342, Pennsylvania’s tax code additionally contained a uniquely giant bias in opposition to small enterprise bills related to investing in equipment, tools, and different short-lived capital belongings. As a substitute of these bills being deductible within the yr they occurred, the Pennsylvania tax code required most of them to be deducted over time in keeping with a depreciation schedule. On the federal stage, Part 179 of the Inside Income Code (IRC) lets small enterprise house owners offset the price of funding by permitting the deduction of as much as $1 million of funding within the yr the investments have been made. Most state allowances conform to this normal, however Pennsylvania solely allowed $25,000 in quick expensing of Part 179 property. That was tied for the smallest quantity within the nation.

With enactment of HB 1342, the Commonwealth now conforms to the inflation-adjusted $1 million federal deduction allowance. This can be a constructive growth for small enterprise house owners and their staff as extra capital formation will increase productiveness, encourages wage progress, and will increase output—all mandatory on the state stage to fight inflation and thrust back the worst results of a looming recession. Enacting well-designed web working loss (NOL) provisions for pass-through companies would additionally contribute to these ends. Though NOLs weren’t addressed in HB 1342, there are various compelling causes to reengage that topic in future laws.

The mixed influence of the CNIT price discount and Part 179 enlargement are maybe greatest illustrated by the change in Pennsylvania’s rating on our State Enterprise Tax Local weather Index. Previous to passage of HB 1342, Pennsylvania’s general structural rating was twenty ninth out of fifty. The person revenue tax construction ranked nineteenth, and the company revenue tax construction ranked forty fourth. In 2023, the Commonwealth will rank twenty third general.

Passage of HB 1342 was a superb begin to making the Commonwealth aggressive once more, however nothing is inevitable till it occurs. If there’s a draw back to the reforms of HB 1342 it’s the 9 years it’ll take for the CNIT price to achieve 4.99 p.c. On the one hand, a number of states with previously excessive charges have adopted the incremental-annual-reduction mannequin. In that sense, Pennsylvania’s elongated reform design isn’t distinctive or essentially trigger for concern. Alternatively, the sluggish tempo of CNIT reductions evokes recollections of Pennsylvania’s phaseout of the capital inventory and franchise tax (CSFT), which was haphazardly paused and restarted for years earlier than lastly being eradicated.

The legislature had the chance to make a daring minimize to the CNIT price this yr and to construction alternatives for future price cuts round well-designed income triggers. As a substitute, the Commonwealth will enter 2023 with a CNIT price that can nonetheless be fifth highest within the nation. Underneath this design, it might take a number of years earlier than charges are aggressive sufficient to entice companies again to the Keystone State.

Within the meantime, lawmakers ought to resist the temptation to deal with CNIT reform with the identical skepticism as CSFT elimination. Slightly, they need to proceed to advance structurally impartial, free-market-enhancing tax laws within the spirit of Indiana, Iowa, and North Carolina. These states additionally began with incremental alterations, however every year they improved on or accelerated the tax reforms enacted in earlier legislative periods.

Indiana has constantly chipped away at its company revenue tax (CIT) price over the past 10 years. In 2012, the CIT price was 8.5 p.c. At this time it’s 4.9 p.c. Iowa handed complete tax reforms in 2018 after which accelerated these reforms with surplus income in 2022. As soon as totally phased in, Iowa could have a extra impartial tax base, a flat particular person revenue tax price of three.9 p.c (down from 8.98 p.c), and a flat company revenue tax price of 5.5 p.c (down from 12 p.c). These reforms have positioned Iowa to enhance from the fifth-worst-structured tax code earlier than 2018 to the Fifteenth-best-structured tax code as soon as reforms are totally phased in. For its half, North Carolina enacted complete tax reform in 2013 after which constructed on these reforms in 2014, 2015, 2017, and 2021. Pennsylvania ought to comply with go well with.

Pennsylvanians must be inspired by the reforms this laws has set in movement. If the reforms of HB 1342 have been totally carried out right now, Pennsylvania’s company construction would rank twenty seventh out of fifty, a drastic enchancment from its present forty fourth. The Commonwealth’s general tax competitiveness rating would enhance to seventeenth from twenty ninth.

To maximise the advantages of the current reforms, the legislature ought to take into account accelerating the CNIT price reductions. Then, to amplify their impact, policymakers ought to conform the Commonwealth’s therapy of web working loss carryforwards to the 80 p.c federal normal whereas equally extending the carryforward provisions to pass-through companies, as almost each different state does.

The legislature must also take into account reforming the Commonwealth’s therapy of revenue. It ought to dispose of the present revenue class construction that doesn’t permit losses from one sort of revenue to offset positive factors from one other. The present design disincentivizes small enterprise house owners who file joint returns from finding in Pennsylvania.

Lastly, Pennsylvania policymakers ought to conform to the federal therapy of capital funding by companies and may take into account making full expensing of capital funding everlasting on the state stage. Many different states already conform to this provision of the Tax Cuts and Jobs Act, however it’ll start to run out in the beginning of 2023. Oklahoma anticipated the change and not too long ago turned the primary state within the nation to make full expensing everlasting on the state stage. Pennsylvania can work in direction of a status of tax competitiveness by changing into the second state to take action.

In accordance with the state treasurer, Pennsylvania was on tempo to complete Fiscal Yr 2022 with a $6.6 billion surplus. Nonetheless, she additionally famous the Keystone State might face a deficit by the top of Fiscal Yr 2025. By prioritizing structural tax reforms, lawmakers made a accountable alternative. Such reforms can generate recurring wage and employment advantages the likes of which a one-time aid test or new program can’t. The reforms of HB 1342 are a superb begin to making Pennsylvania-based companies extra aggressive and to fueling productiveness and wage progress within the Commonwealth. As lawmakers in Harrisburg take into account easy methods to proceed sooner or later, they need to construct on the current reforms with confidence and a watch to the successes of states that have been as soon as of their place.