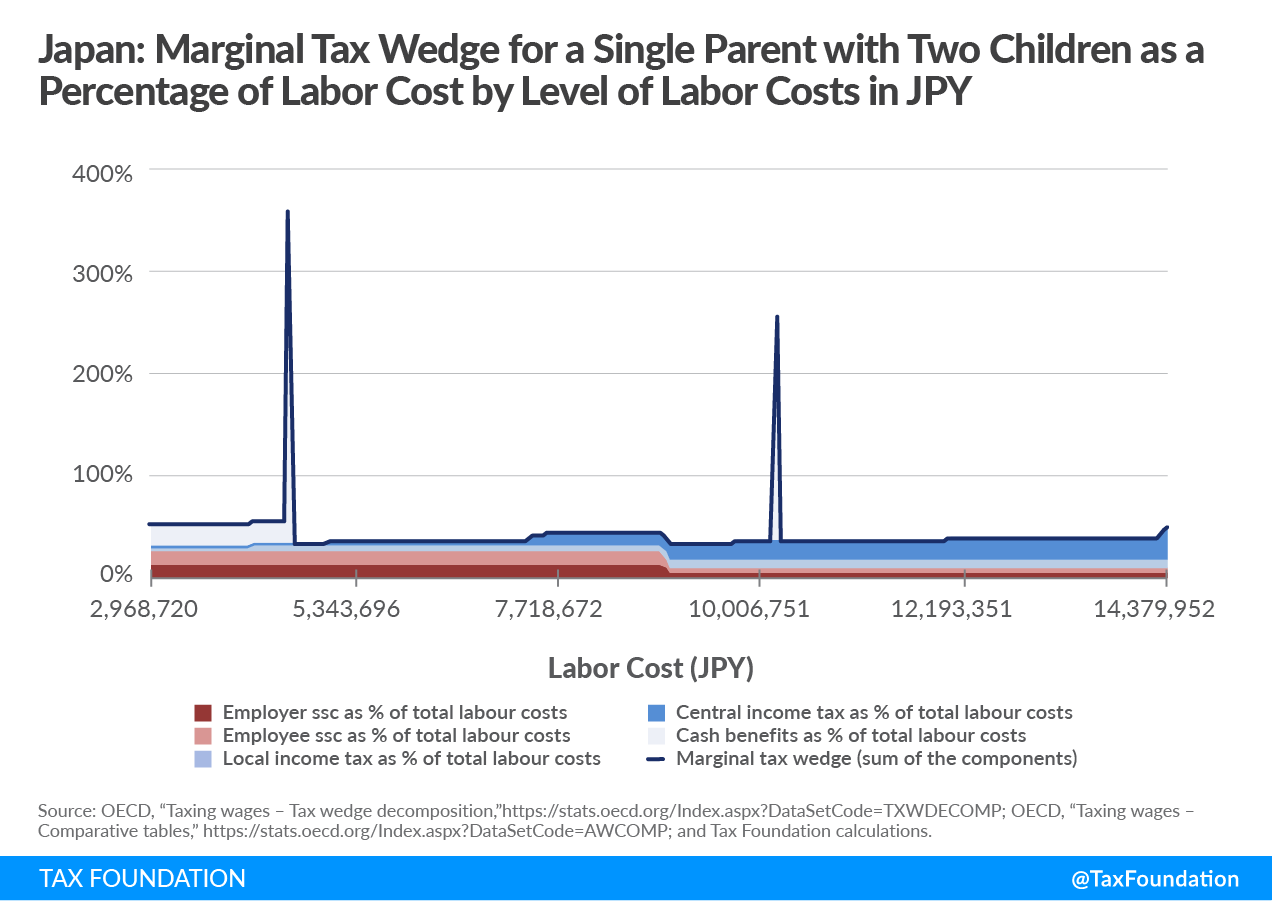

Think about {that a} authorities gives subsidies to single mother and father that really improve tax charges on extra work. That is the case for a Japanese single father or mother who earns a tough equal of US $39,981 and faces a 57 p.c marginal tax charge. With only a small improve in pay of $599, she would face a 359 p.c marginal tax charge. A Japanese father or mother who advantages from a authorities program price $5,123 may lose one hundred pc of that profit if she or he earns above the earnings threshold.

This is the reason the marginal tax wedge is related for understanding how staff may profit (or not) from a rise in pay as soon as taxes enter the image.

Whereas the tax and profit system may be profitable in conserving low-income working households out of poverty and inspiring workforce participation, excessive marginal tax charges just like the one noticed within the case of this Japanese working father or mother act as obstacles to upward mobility, discouraging mother and father from advancing of their careers. Fairly often these excessive charges are hidden in advanced tax buildings. Nonetheless, a just lately revealed research by Archbridge Institute and Tax Basis highlights the underlying insurance policies that drive the marginal tax charge spikes that staff are topic to in quite a few international locations.

When shifting up the revenue ladder a Japanese employee with kids can face tax charge spikes of over 250 p.c at two completely different factors as a result of child-rearing allowance and youngster advantages.

| Japanese Single Father or mother with Two Youngsters Common Labor Value: JPY 5,937,440 (US $59,899) | ||

|---|---|---|

| Complete Labor Value | JPY 4,571,829 | JPY 10,170,746 |

| Internet Earnings Earlier than the Increase | JPY 3,562,284 | JPY 6,778,705 |

| Quantity of the Increase | JPY 59,374 | JPY 54,665 |

| Quantity of Extra Tax/Advantages Discount Because of the Increase | JPY 213,227 | JPY 140,751 |

| % of the Increase Eaten up by the MTR | 359.12% | 257.48% |

| Internet Earnings After the Increase | JPY 3,408,432 | JPY 6,692,619 |

| Supply: OECD, “Taxing wages – Tax wedge decomposition,” https://stats.oecd.org/Index.aspx?DataSetCode=TXWDECOMP; OECD, “Taxing wages – Comparative tables,” https://stats.oecd.org/Index.aspx?DataSetCode=AWCOMP; and Tax Basis calculations. | ||

In 2021, the primary marginal tax charge spike occurred at 77 p.c of the typical wage and roughly 88 p.c of the median wage. If the employer of this Japanese employee elevated compensation by simply JPY 59,374, the employee confronted a web loss and noticed his earnings lower by JPY 153,853. This Japanese father or mother confronted a marginal tax wedge of 359 p.c for a 1 p.c improve in gross earnings on prime of the gross annual wage of JPY 3,963,097. It’s because the child-rearing allowance, which is a profit obtainable for single mother and father, disappears on the revenue cap.

Transferring up the revenue ladder this employee confronted a marginal tax wedge of 257 p.c for a 1 p.c improve in gross earnings on prime of the gross annual wage of JPY 8,904,101. This Japanese single father or mother confronted a web loss and noticed his earnings lower by JPY 86,086. This is because of child benefits being lower by half from JPY 240,000 to JPY 120,000 when the cap of JPY 6,980,000 is reached.

Each the child-rearing allowance and the kid profit generate marginal tax charge spikes of over 250 p.c as they attain the revenue cap. A gradual fading of those advantages would remove these tax spikes.

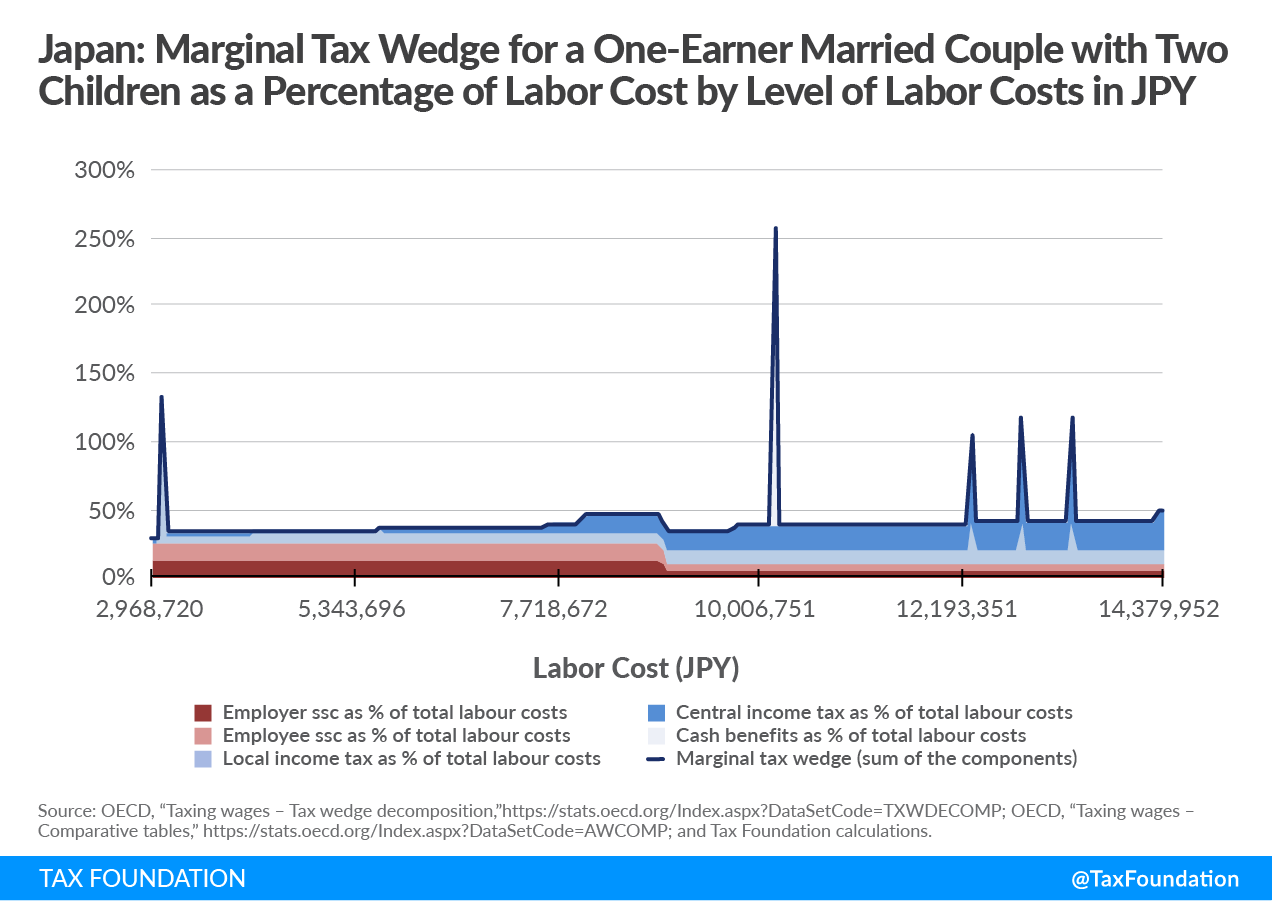

Moreover, a one-earner Japanese couple with two kids confronted marginal tax charges of over one hundred pc at 5 completely different factors as a result of youngster allowance, but additionally because of native fastened commonplace tax and partner’s allowance.

| Japanese One-Earner Married Couple with Two Youngsters Common Labor Value: JPY 5,937,440 (US $59,899) | |||||

|---|---|---|---|---|---|

| Complete Labor Value | JPY 3,087,469 | JPY 10,170,746 | JPY 12,302,681 | JPY 12,849,331 | JPY 13,395,981 |

| Internet Earnings Earlier than the Increase | JPY 2,496,730 | JPY 6,889,301 | JPY 8,091,945 | JPY 8,381,282 | JPY 8,663,965 |

| Quantity of the Increase | JPY 59,374 | JPY 54,665 | JPY 54,665 | JPY 54,665 | JPY 54,665 |

| Quantity of Extra Tax/Advantages Discount Because of the Increase | JPY 79,334 | JPY 140,751 | JPY 57,116 | JPY 63,772 | JPY 63,772 |

| % of the Increase Eaten Up by the MTR | 133.62% | 257.48% | 104.48% | 116.66% | 116.66% |

| Internet Earnings After the Increase | JPY 2,476,770 | JPY 6,803,215 | JPY 8,089,493 | JPY 8,372,176 | JPY 8,654,858 |

| Supply: OECD, “Taxing wages – Tax wedge decomposition,” https://stats.oecd.org/Index.aspx?DataSetCode=TXWDECOMP; OECD, “Taxing wages – Comparative tables,” https://stats.oecd.org/Index.aspx?DataSetCode=AWCOMP; and Tax Basis calculations. | |||||

For this couple, the primary marginal tax charge spike occurred at 52 p.c of the typical wage and roughly 60 p.c of the median wage. If the employer of this Japanese employee elevated compensation by simply JPY 59,374, the employee confronted a web loss and noticed his earnings lower by JPY 19,960. This Japanese couple confronted a marginal tax wedge of 134 p.c for a 1 p.c improve in gross earnings on prime of the gross annual wage of JPY 2,676,377. It’s because at this stage of revenue, along with the native fastened commonplace tax of JPY 5,000, a ten p.c local income tax is due.

The second marginal tax charge spike that this Japanese couple confronted was as a result of cap on youngster advantages, as within the case of a single father or mother with two kids.

Transferring up the revenue ladder this employee confronted a marginal tax wedge of 104 p.c for a 1 p.c improve in gross earnings on prime of the gross annual wage of JPY 10,911,384. This Japanese couple with two kids confronted a web loss and noticed their earnings lower by JPY 2,451.

This Japanese couple with two kids confronted two extra marginal tax wedges of 117 p.c for a 1 p.c improve in gross earnings on prime of the gross annual wage of JPY 11,426,072 and JPY 11,940,760. These final three will increase within the marginal tax wedge generated by the rise in revenue taxes are as a result of gradual lack of the spouse’s allowance by one-third of its preliminary quantity till it’s utterly withdrawn. Subsequently, a gradual discount of the partner allowance would drastically scale back these three marginal tax charge spikes.

The tax and profit system in Japan is extraordinarily advanced with quite a few thresholds. Moreover, the existence of various tax advantages and thresholds for single mother and father and one-earner {couples} generates a collection of marginal tax charges that may preserve some staff in Australia slightly below the edge earnings that set off the tax charge spikes. Eliminating these obstacles by implementing a extra homogenous tax and profit system will enable staff to have entry to increased wages with out confronting these obstacles.

Moreover, the varied ranges of revenue tax and the design of the native revenue tax create a poverty lure for one-earner {couples}. With a purpose to remove this poverty lure, the fastened commonplace native tax must be eradicated and regional and native revenue tax charges and thresholds must be aligned.

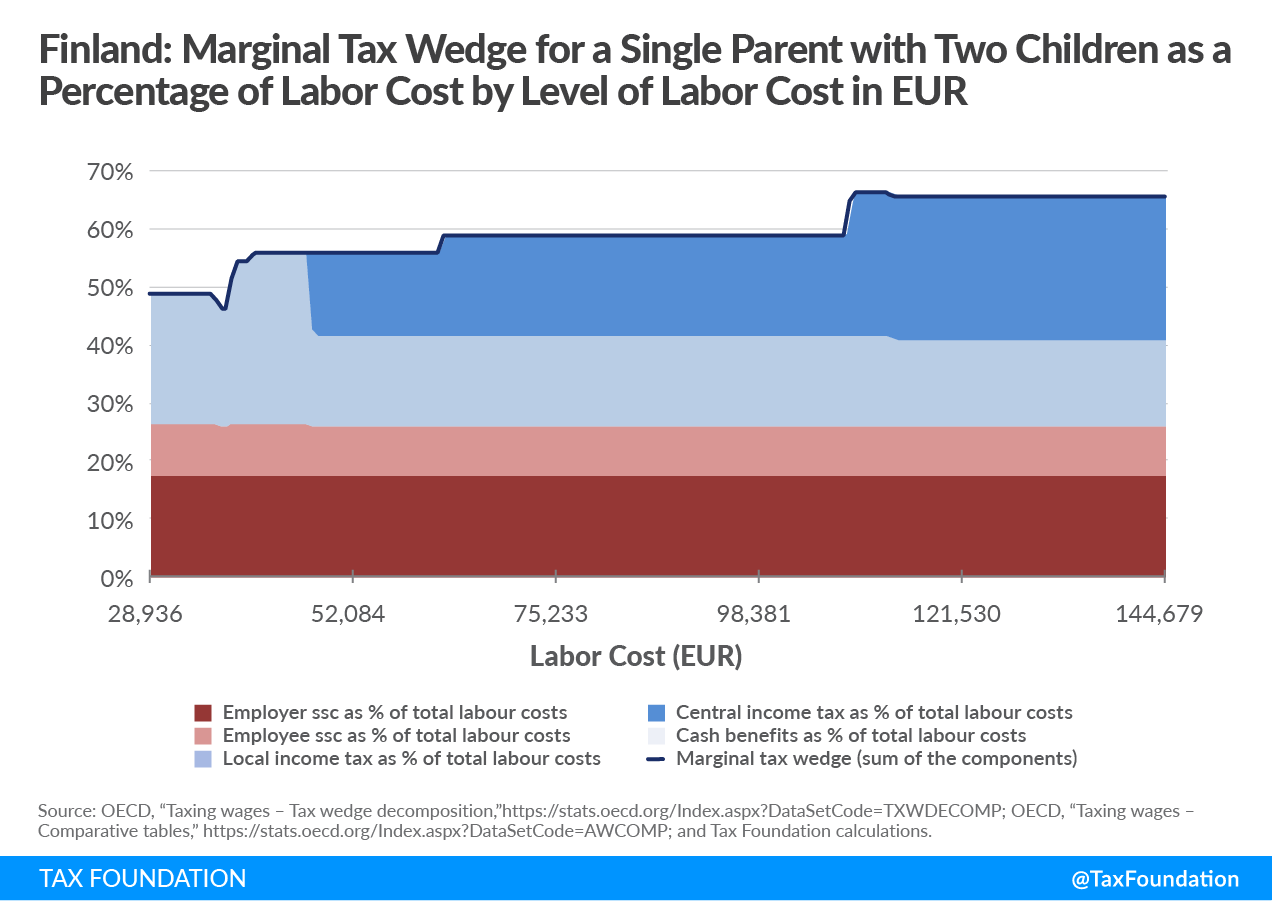

Two Classes from Finland

Japan might observe the instance of Finland the place each central and native revenue taxes function collectively. In Finland, the native revenue tax and the central revenue tax are adjusted and well-coordinated and don’t generate marginal tax charge spikes like those described in Japan. Finland additionally provides a set child allowance impartial of taxable revenue that forestalls the formation of marginal tax charge spikes like those noticed in Japan. However, marginal tax charges above 50 p.c as those noticed in Finland may discourage employment and labor provide. Even when marginal charges don’t spike in a manner that traps individuals in poverty, excessive marginal charges nonetheless impression staff instantly.

Finland. Marginal Tax Wedge for a Single Father or mother with Two Youngsters as a Share of Labor Value by Stage of Labor Value in EUR

The loss in advantages that particularly Japanese single mother and father and one-earner {couples} face when taking over extra work hours can deter them from advancing of their careers, exhibiting that the tax-benefit system is inefficient in selling the upward mobility of oldsters. The Japanese tax and profit system comes with trade-offs that policymakers should take into accout when planning to reform the tax coverage. In Japan, even near poverty-level mother and father are impacted by marginal tax charge spikes. Subsequently, reshaping a few of these insurance policies to generate a smoother variation of marginal tax charges over completely different revenue ranges and family sorts would probably increase labor provide and encourage the upward mobility of Japanese mother and father.

Word: That is a part of a five-part weblog collection that highlights the findings of a just lately revealed research by Archbridge Institute and Tax Basis and explores the underlying insurance policies that drive the marginal tax charge spikes that staff are topic to in quite a few international locations.