The federal authorities introduced one other enhance in rates of interest of three-quarters of a proportion level for the second time in two months in an effort to struggle inflation. The current rate of interest hikes, essentially the most aggressive because the Eighties financial disaster, intention to sluggish spending that has been a consider rising inflation.

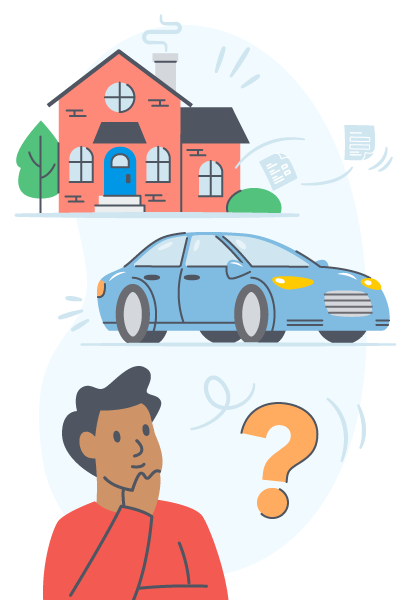

Chances are you’ll be questioning “How will the rise in rates of interest influence my funds?” and “What can I do to guard my funds?”

There are just a few methods the Federal reserve hike can influence your funds.

- It could value extra to borrow. Whereas elevating rates of interest slows inflation, loans like mortgages, bank cards, and auto loans tied to prime charges could get costlier.

- Scholar loans could also be costlier. Non-public pupil loans are tied to Federal charges so your rates of interest and funds might rise.

Though you may even see will increase within the quantities you must pay in your loans there are some strikes you can also make now to guard your funds.

- Pay down debt. You probably have debt tied to the prime price like bank card debt, repay your debt as quickly as attainable in the event you can. Particularly since rates of interest could enhance once more this 12 months. That can assist you sort out your debt you may attempt the debt snowball methodology and begin paying your lowest steadiness debt first and work your method up, making use of the cost you have been making to the following excellent steadiness.

- Refinance for decrease rates of interest. With the potential of rates of interest rising once more you could need to take into account refinancing any high-variable rate of interest loans on your house mortgage or pupil loans to a hard and fast price mortgage. At tax-time, you’ll nonetheless have the ability to deduct your house mortgage curiosity and also you could possibly deduct your pupil mortgage curiosity as much as $2,500. If you happen to refinance your house mortgage, you additionally could possibly deduct the factors you pay on the refinance of your house.

- Consolidate Debt. You probably have excellent bank card balances, take into account transferring them to a low curiosity and in some instances zero curiosity steadiness switch bank cards. Many bank card firms have low introductory price bank cards that help you pay low or zero curiosity on balances for a sure time period earlier than charges change. The secret is to take full benefit of the low rates of interest and pay your balances off throughout the introductory interval.

- Enhance Your Credit score Rating. By boosting your credit score rating it is possible for you to to benefit from decrease rates of interest whether or not in search of a house mortgage or decrease curiosity bank card. To extend your rating, make your debt cost on time and pay down debt preserving your credit score utilization ratio low.

- Save for a Wet Day. In instances of rising rates of interest you need to have an emergency fund so that you just don’t need to depend on excessive rate of interest bank cards when you have got an emergency.

Many states are offering their very own stimulus aid packages to assist ease the burden of inflation that households are experiencing. California is likely one of the states that not too long ago handed the California Stimulus Reduction Package deal in July.

Verify again with the TurboTax weblog to search out out updated information and the newest on tax legal guidelines and finance tendencies.

-

Earlier Publish

Enhance Your Again-to-College Financial savings

The federal authorities introduced one other rates of interest enhance. Listed here are just a few methods the federal reserve hike can influence your funds.