As Congress considers a number of tax proposals designed to boost taxes on high-income earners, it’s value contemplating the distribution of the present tax code. Whereas the picture that wealthy People pay little taxes is standard, it’s a false impression: high-income people already pay a big share of taxes, even when in comparison with their share of nationwide revenue.

Knowledge and evaluation from the preeminent nonpartisan governmental analysis organizations confirms this sample.

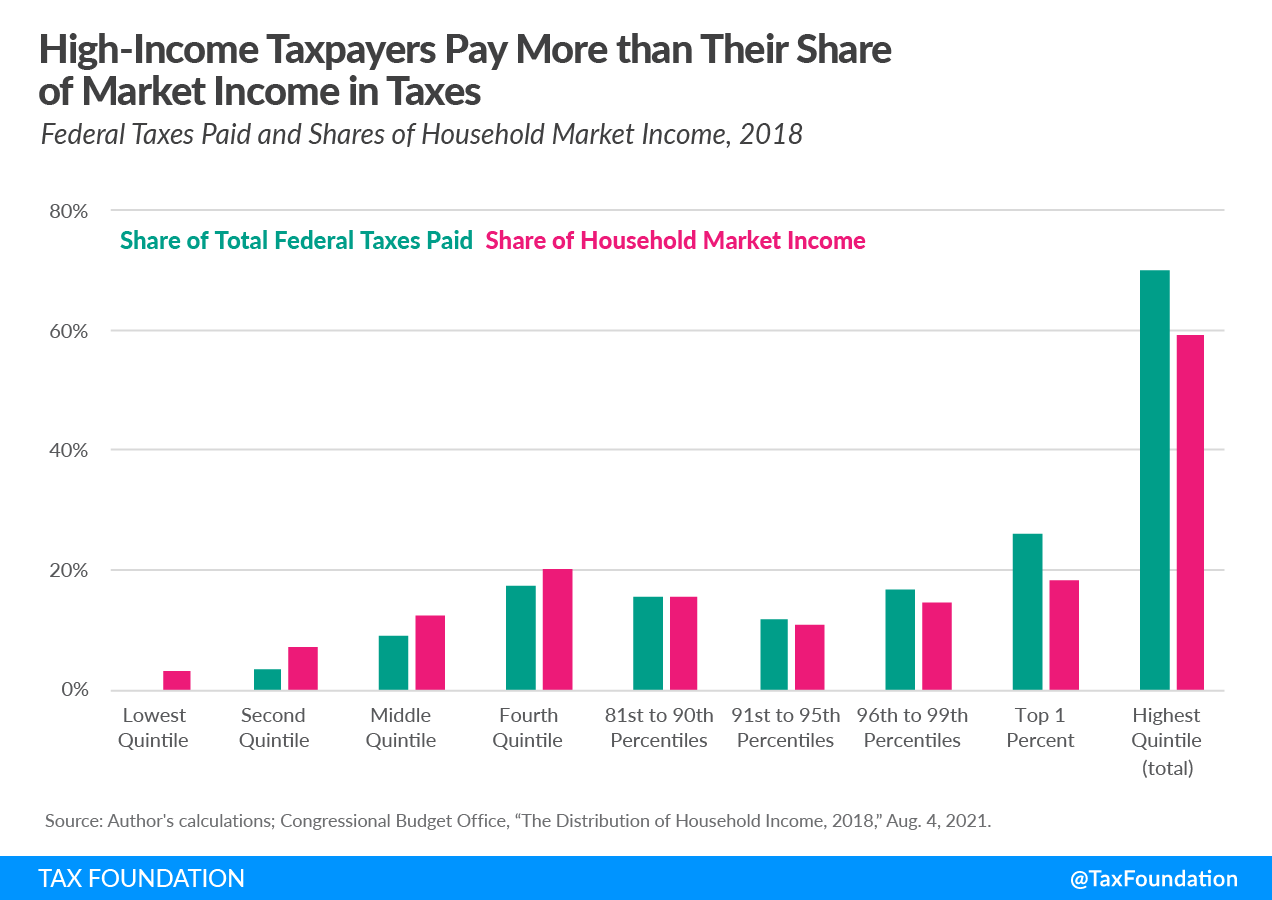

This August, the Congressional Funds Workplace (CBO) launched its annual Distribution of Family Revenue report, this 12 months counting on knowledge from 2018. The report examines the distribution of family revenue (as one would possibly guess), in addition to taxes and switch funds. The info reveals that top-earning households pay substantial federal taxes. Notably, whereas the highest 1 p.c of earners took residence 18.3 p.c of market revenue in 2018, they paid 25.9 p.c of all federal taxes; by the identical token, the highest 20 p.c of earners acquired 59.1 p.c of market revenue but paid 68.9 p.c of federal taxes.

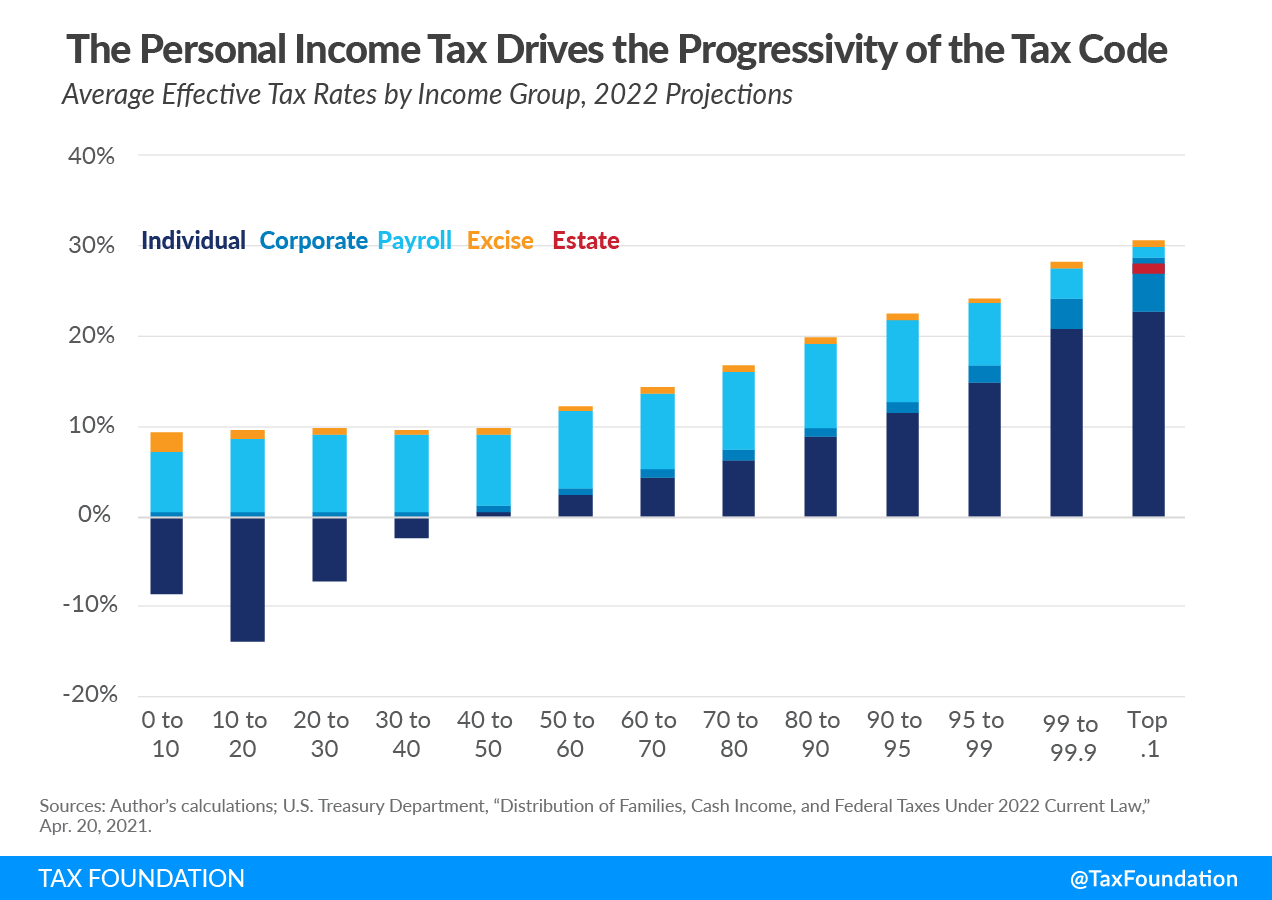

The Treasury Division has additionally launched knowledge confirming the above sample. In a report launched this April, they estimated the distribution of federal tax burden throughout the revenue spectrum in 2022. In response to these estimates, the highest 1 p.c beneath present legislation can pay the best common efficient tax charge, when contemplating all federal taxes. This distinction is essentially because of the vital progressivity of the person revenue tax: the underside 40 p.c of taxpayers on common pay destructive efficient private revenue tax.

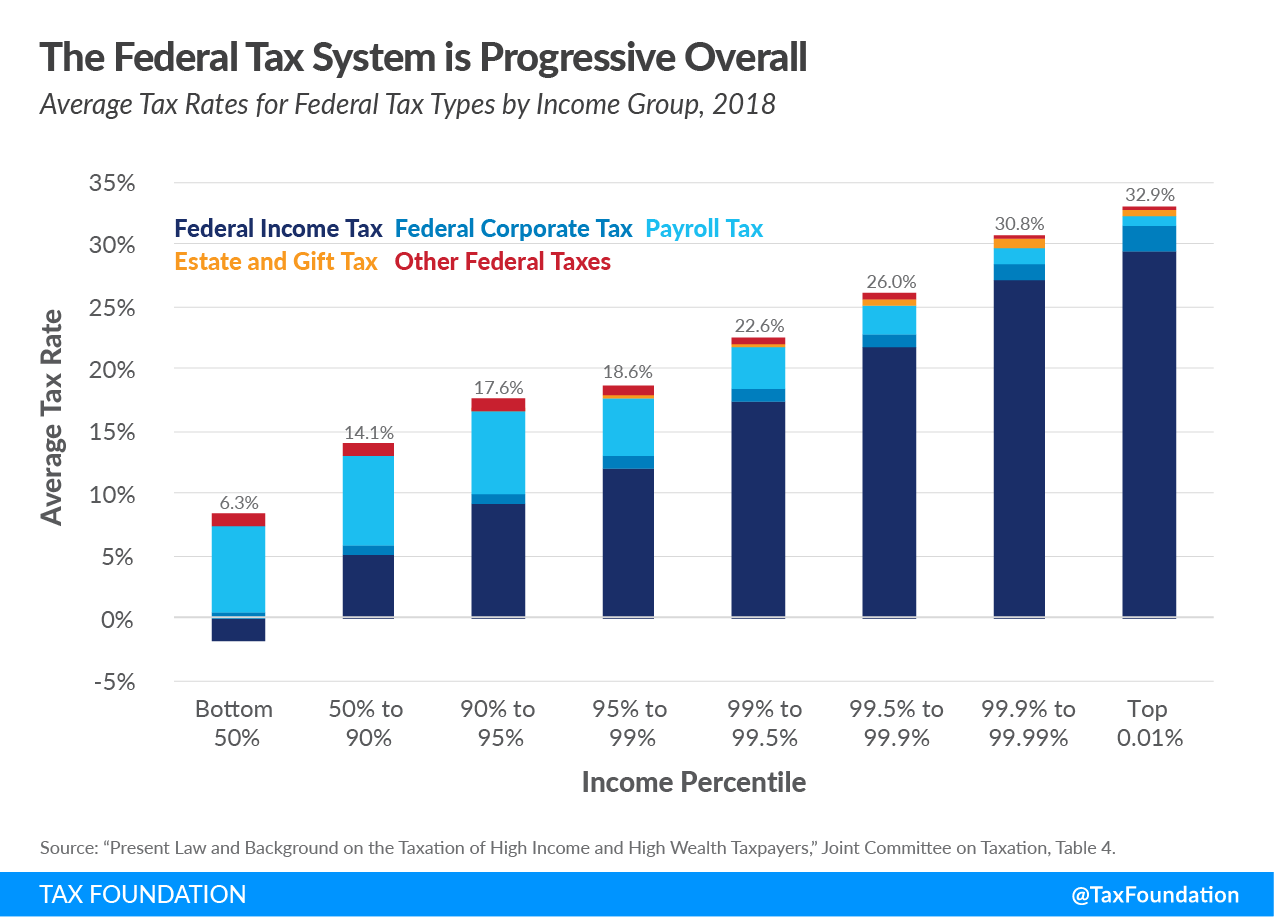

The Joint Committee on Taxation (JCT) revealed an analysis reaching an identical conclusion in regards to the distribution of the tax code in 2018. My colleague Garrett Watson mentioned the information this Could. The unique report discovered that the burden of federal taxes was a lot greater on high-earning households. They paid a a lot greater efficient charge in complete, equally because of the progressivity of the non-public revenue tax.

It’s additionally value noting that these analyses predominantly deal with pre-pandemic knowledge. The fiscal response to COVID-19 relied closely on refundable tax credit, reducing the efficient private revenue tax charge for a majority of taxpayers to under or practically zero. The Tax Coverage Heart just lately estimated that 60.6 p.c of households paid no particular person revenue tax in 2020. In mild of those estimates, distribution of the U.S. tax burden was doubtless much more skewed in direction of rich taxpayers.

In fact, some people will argue that even when the tax code is at the moment progressive, it needs to be much more progressive. However they need to not dispute the truth that the rich pay a bigger share of federal taxes than they earn of nationwide revenue.

Was this web page useful to you?

Thank You!

The Tax Basis works laborious to offer insightful tax coverage evaluation. Our work relies on assist from members of the general public such as you. Would you think about contributing to our work?

Contribute to the Tax Foundation

Tell us how we will higher serve you!

We work laborious to make our evaluation as helpful as potential. Would you think about telling us extra about how we will do higher?