The COVID-19 pandemic introduced elevated consideration to U.S. world provide chains, because the pandemic impacted crucial parts inside U.S. manufacturing. The eye has led to calls to construction U.S. tax coverage to encourage companies to increase their manufacturing capability within the U.S., underneath the idea home provide chains are inherently much less dangerous than world ones.

However the perception is mistaken, as a result of world provide chains truly cut back danger, quite than improve it. One of many advantages of multinational exercise is that it permits companies to attenuate the dangers of country-specific shocks.

For instance, contemplate the U.S. meatpacking business. In 2020, the U.S. produced about $123 billion worth of beef, and only 5.4 percent of U.S. beef consumption consisted of beef imported from Canada and Mexico, our largest buying and selling companions on this market. Regardless of being a primarily domestic-based business, U.S. meatpacking was significantly disrupted by the coronavirus. Whereas the U.S. meatpacking business could itself not have as advanced a provide chain as different industries, the instance illustrates that even industries which might be largely U.S.-based are nonetheless extremely inclined to produce shocks.

From a portfolio funding perspective, cross-border funding permits companies and people to diversify their portfolios and acquire a number of strategies of financing for tasks. U.S. companies can obtain overseas funding for dangerous tasks, which exerts downward strain on rates of interest and reduces the necessity for elevated home saving to finance investments. Equally, U.S. companies and buyers can cut back their publicity to U.S. financial dangers by investing in different international locations.

In some circumstances, nonetheless, U.S. companies working in sure international locations could should face extra political dangers. As one instance, China has enacted a lot more draconian lockdowns all through the pandemic than different international locations, which affects U.S. multinationals operating there. Nonetheless, quite than orienting coverage to encourage companies to “onshore” their exercise, it could be prudent to encourage them (or at that very least, not discourage them from) increasing operations in different international locations that carry fewer political dangers. Certainly, many companies have already revealed plans to do so impartial of any U.S. coverage, reflecting ongoing considerations about elevated regulatory dangers in China. Continued engagement with buying and selling companions within the Indo-Pacific region would additionally possible incentivize U.S. companies to maneuver their operations to extra secure international locations.

commerce information might help reveal how FDI provides worth to the availability chain, also called the worldwide worth chain (GVC). The Bureau of Financial Evaluation’ new Trade in Value-Added dataset reveals how GVCs add worth to completed merchandise that the U.S. exports. For instance, if the U.S. exports a automobile valued at $25,000 to Canada, how a lot of the worth was generated in U.S. versus in overseas jurisdictions? A few of the worth is generated within the U.S. manufacturing business, the place the automobile is assembled, however producing a automobile requires sourcing and refining metals, which can be imported from foreigners.

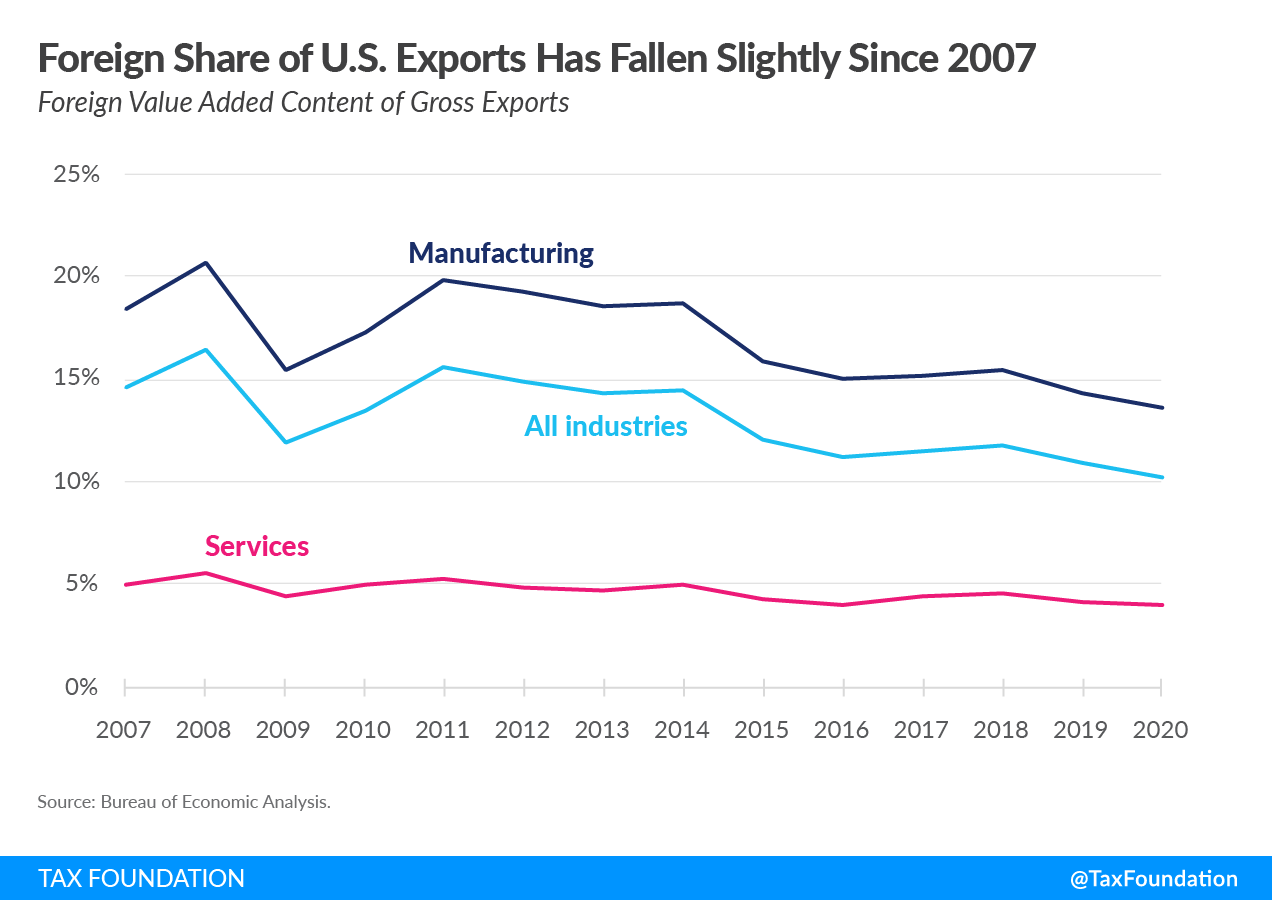

As proven within the following chart, roughly 10 p.c of the value-added in U.S. gross exports is produced overseas, and the share has solely barely fallen over time. manufacturing solely, the value-added from overseas producers is modestly increased at 14 p.c. Industries differ fairly considerably of their overseas share of value-added, particularly inside manufacturing. Pharmaceutical manufacturing has a a lot bigger share of overseas sourcing than different industries, at 23 p.c, and for petroleum manufacturing, greater than one-quarter of the worth is produced overseas.

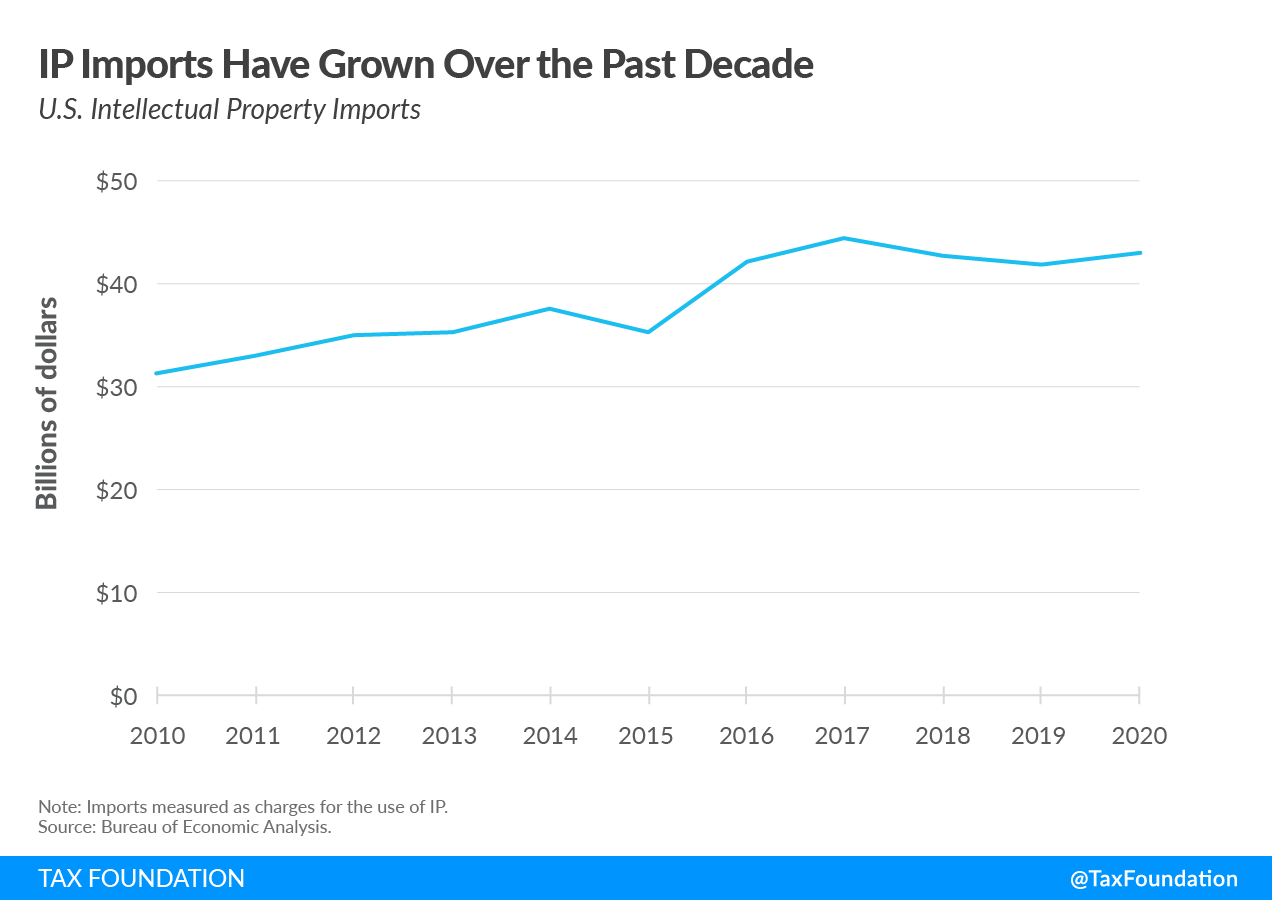

Importantly, though this information captures how invaluable overseas international locations are to the U.S. provide chain, it truly understates the worth U.S. companies contribute to merchandise. Commerce information solely captures the tangible inputs right into a closing product, however a major share of the worth of U.S. output is generated by “intangibles,” such because the model worth and different types of mental property (IP). Imports of IP companies, measured within the following chart as expenses for the usage of IP overseas, has grown considerably over time, reaching $43 billion in 2020. Notably, IP imports associated to analysis and growth grew after the Tax Cuts and Jobs Act (TCJA) as firms have been incentivized to maneuver their IP out of low-tax jurisdictions.

As an example the worth of IP to the availability chain, let’s take a look at the Apple iPhone as one instance. The direct inputs are produced in a wide range of international locations, assembled in China, after which bought within the U.S. The manufacturing and distribution prices account for barely greater than half of the retail worth, implying a big revenue margin for Apple; within the following instance, roughly 45 p.c. However the analysis and growth that helped produce the iPhone, the institution of a educated workforce that may help customers, and the power to combine the iPhone with different Apple merchandise all add worth to the iPhone and carry attendant prices.

As intangibles comprise a bigger share of commerce over time, accounting for its provide from U.S. guardian firms to overseas associates might have an effect on measured income and as effectively value-added estimates by U.S. guardian firms. One estimate from World Bank economists discovered that accounting for IP prices might decrease the return on invested capital by as a lot as 29 share factors for high companies. Within the Apple iPhone instance, this would scale back the revenue margin to 16 p.c.

| Prices of bodily parts and meeting | $194.04 |

| U.S. | $24.63 |

| Overseas | $169.41 |

| Distribution and different prices | $135.95 |

| Whole value of manufacturing | $329.99 |

| Retail worth | $600.00 |

| Revenue | $270.01 |

| Revenue after changes for IP investments | $96.01 |

| Supply: C. Fitz Foley, James Hines, and David Wessel (eds.), World Goliaths: Multinational Firms within the 21st Century (Washington, D.C.: Brookings Establishment Press), 2021. See additionally Meghana Ayyagari et al., “The Rise of Star Companies: Intangible Capital and Competitors,” World Financial institution Coverage Analysis Working Paper No. 8832, 2019. | |

Though the dispersion of our provide chains all through the world has been scrutinized in recent times, each inbound and outbound FDI are crucial to sustaining provide chain resiliency and lowering financial dangers for each companies and buyers. Policymakers ought to proceed to make sure that companies have the power to freely make investments overseas.