President Biden and congressional Democrats have justified their plan to boost taxes on the wealthy to fund a lot of their $3.5 trillion spending by claiming that the tax code is just not progressive sufficient. But a current Joint Committee on Taxation (JCT) analysis of the Home Methods and Means tax plan undermines that thesis by displaying that high-income taxpayers already bear a disproportionate share of the federal tax burden and that the tax proposal would merely make that burden extra disproportionate.

One has to surprise how secure or sustainable the Democrats’ spending program will be if it should rely so closely on the taxes paid by such a small variety of taxpayers as within the high 1 p.c.

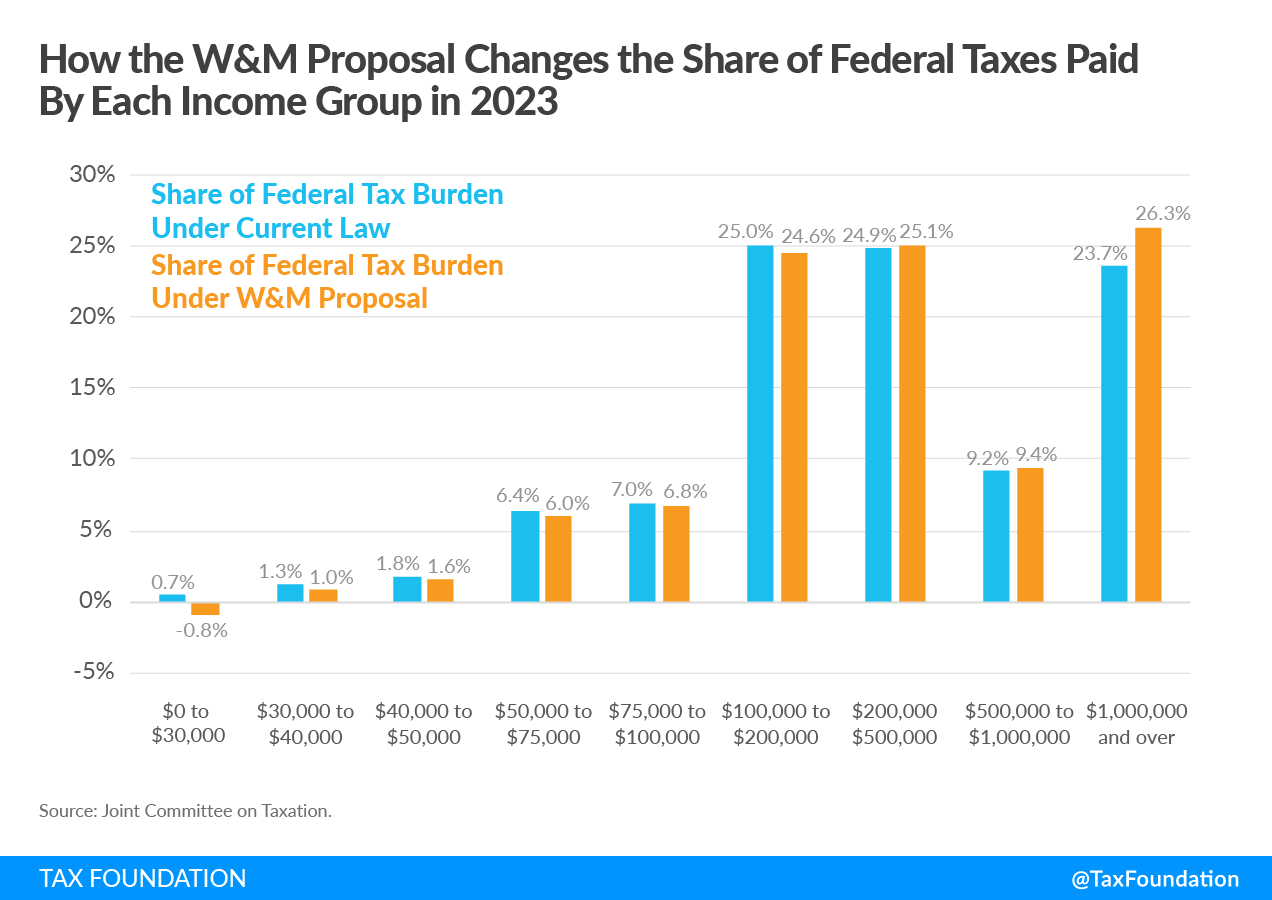

The accompanying chart exhibits how a lot of the present federal tax system is borne by high-income taxpayers and the way little is paid by taxpayers incomes below $100,000. In 2023, JCT estimates that below present legislation, taxpayers incomes below $100,000 (totaling 124 million) will collectively pay 17.2 p.c of all federal taxes, together with, earnings taxes, payroll taxes, company taxes, and excise taxes. This quantities to $655 billion out of the greater than $3.8 trillion in anticipated complete federal revenues that 12 months below present legislation.

Millionaires Pay a Larger Share of Federal Tax Burden than 124 Million Neighbors

In contrast, according to the IRS, there are roughly 500,000 taxpayers with incomes above $1 million. JCT estimates that these taxpayers can pay practically 24 p.c of all federal taxes in 2023, amounting to $908 billion. In different phrases, the comparatively small variety of taxpayers with incomes above $1 million can pay a considerably larger share of all federal taxes than some 124 million of their neighbors mixed.

The remaining share of the tax burden is borne by taxpayers with incomes above $100,000 and fewer than $1 million. For instance, there are about 21 million taxpayers incomes between $100,000 and $200,000 and JCT estimates that they may pay 25 p.c of all federal taxes in 2023. The practically 7 million taxpayers incomes between $200,000 and $500,000 are also anticipated to pay 25 p.c of the tax burden.

There are about 1.1 million taxpayers who earn between $500,000 and $1 million and JCT estimates that they may pay 9.2 p.c of all federal taxes in 2023. If we mix this group with these with incomes above $1 million, it roughly equates to the highest 1 p.c of taxpayers. Mixed, the highest 1 p.c of taxpayers pays practically one-third of all federal taxes. By any definition, it is a very progressive tax system.

The Home Methods and Means Plan Makes a Very Progressive System Even Extra Progressive

However the Home Methods and Means tax plan would make this method much more progressive. Due to the plan’s large growth of tax applications such because the Little one Tax Credit score (the unique phrases reported to be reduce by the Democrats) and Earned Revenue Tax Credit score, the share of federal taxes paid by these incomes below $100,000 would fall to 14.6 p.c, or $555 billion out of the $3.8 trillion in complete federal income that JCT estimates shall be collected in 2023.

Since these tax credit are additionally accessible to some upper-middle-class taxpayers, we are able to see that the tax burden on taxpayers incomes between $100,000 and $200,000 would shrink barely, from 25 p.c to 24.6 p.c. In the meantime, taxpayers incomes between $200,000 and $500,000 would see their share of the tax burden rise barely, to 25.1 p.c.

On the high finish of the earnings scale, millionaires would see their share of the federal tax burden rise to 26.3 p.c, amounting to greater than $1 trillion in complete taxes paid. When mixed with the share paid by these incomes between $500,000 to $1 million, the highest 1 p.c of taxpayers would see their share of the federal tax burden rise to 35.7 p.c, or practically $1.4 trillion.

May San Antonio Fund the Remainder of America’s Advantages?

That 1 p.c of taxpayers is the same as a inhabitants the dimensions of San Antonio. Asking such a small group of People to fund a significant growth of federal applications that profit the remainder of the nation appears unfair at finest and fiscally irresponsible at worst.

The plan’s advocates could reply that JCT’s 2023 estimates are simply the primary 12 months of a 10-year tax plan and a lot of the plan’s insurance policies, such because the Little one Tax Credit score, are set to sundown after 2025, which can revert the relative tax burdens to the present degree of progressivity.

Nevertheless, now we have seen this case earlier than, throughout the so-called Fiscal Cliff episode on the finish of 2012, when all the Bush tax cuts of 2001 and 2002 have been set to run out. President Obama and leaders in Congress agreed on a deal that made everlasting lots of the tax cuts in place for the center class however raised the highest marginal tax charge again to 39.6 p.c and restricted itemized deductions and private exemptions for high-income taxpayers. Primarily based on this historical past, JCT’s estimate for 2023 is probably going a way more sensible image of the longer term steadiness of federal tax burdens than its estimate for 2031.

And people numbers are unsustainable.

Was this web page useful to you?

Thank You!

The Tax Basis works exhausting to supply insightful tax coverage evaluation. Our work depends upon help from members of the general public such as you. Would you think about contributing to our work?

Contribute to the Tax Foundation

Tell us how we are able to higher serve you!

We work exhausting to make our evaluation as helpful as potential. Would you think about telling us extra about how we are able to do higher?