The breakdown of provide chains each domestically and worldwide at the moment dominates headlines. One robust rationalization of provide chain failures is the dramatic improve in federal spending all through the pandemic—elevating mixture demand—mixed with the COVID 19-era shift of consumption from providers to bodily items. That, coupled with preexisting issues that restrict the power of our ports and different elements of the nation’s logistical spine to extend capability, explains a lot of the wait instances and shortages occurring right this moment.

Whereas tax coverage is neither a direct reason behind nor instant resolution to right this moment’s provide chain woes, fixing how the tax code treats inventories and different capital investments may make provide chains extra resilient going ahead.

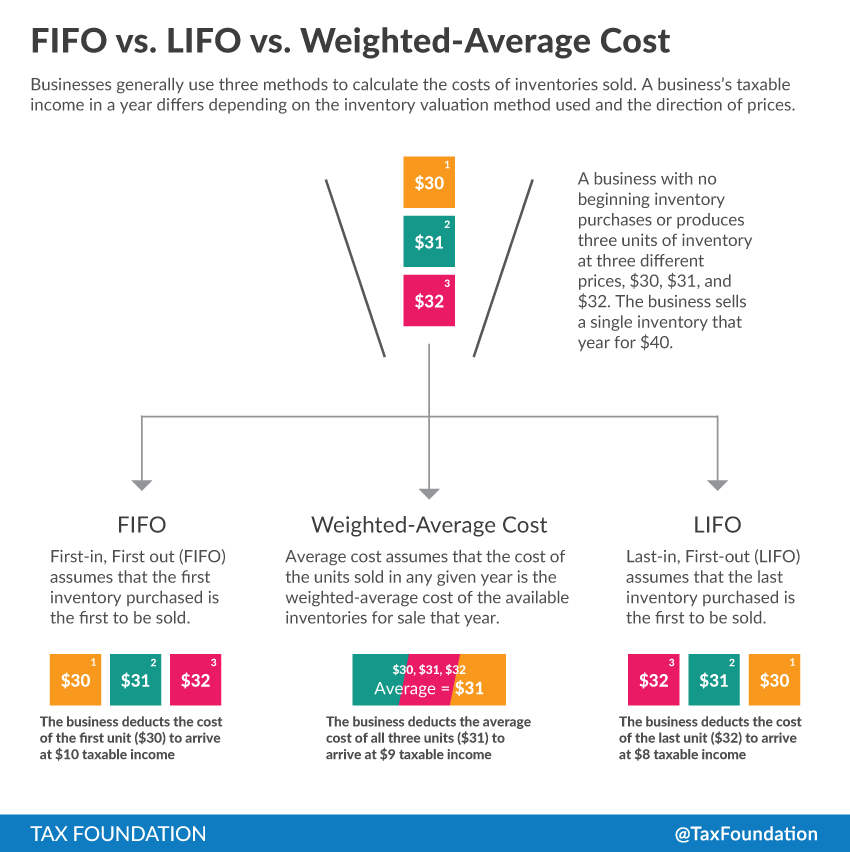

Beneath the present tax code, firms don’t get to deduct the price of inventories when they’re bought; as an alternative, they wait till inventories are offered. The tax code supplies three strategies for figuring out the quantity that may be deducted when a unit of stock sells. First-in, First-out (FIFO) permits firms to deduct the quantity paid for the oldest unit of that type of stock in inventory. Final-in, First-out (LIFO) permits firms to deduct the quantity paid for essentially the most just lately bought piece of stock. And the weighted-average value technique permits corporations to deduct the common value of all stock models.

In the end, to deal with stock prices neutrally, corporations needs to be allowed to deduct prices when stock is bought as an alternative of ready till it sells. No strategies at the moment permit that, however LIFO will get nearer than the others. As a result of costs are likely to rise over time, having firms deduct the quantity paid for the oldest models of their stock normally means they’re deducting a lot lower than the worth of a substitute stock unit. Permitting corporations to deduct essentially the most recently-purchased unit, as LIFO does, comes nearer to matching the price of the substitute unit.

The impression of stopping in need of a full, instant deduction is a tax bias in opposition to stock spending—in different phrases, this tax remedy raises the marginal value of buying extra stock to maintain in inventory. As Kyle Pomerleau of the American Enterprise Institute noted in a paper final yr, the marginal tax fee on enterprise funding in stock is 30 p.c—greater than investments in mental property, tools, constructions, and land. And as my colleague Erica York wrote earlier this yr, transferring to a system that enables stock to be deducted when bought may repair a tax system that encourages just-in-time manufacturing.

There are another tax points that would enhance the resiliency of provide chains. One main story of the provision chain disaster is how the Port of Los Angeles and the Port of Virginia have responded. The Port of Los Angeles has suffered from huge delays, with 100 cargo ships caught in a holding sample within the harbor this October (versus solely 17 beneath typical circumstances). And a latest report named the Port of Los Angeles one of many least efficient on the earth.

In the meantime, the Port of Virginia’s operations have continued largely uninterrupted. One important rationalization for the distinction is the Port of Virginia is extra closely automated, which requires capital funding in newer equipment and tools. Permitting firms to completely deduct capital funding places capital prices on the identical footing as wage bills and makes capacity-enhancing investments extra probably. Productiveness-growing investments additionally assist elevate wages for employees.

Whereas taxes usually are not on the root of provide chain disruptions, enhancements to the tax code may make provide chains extra resilient sooner or later.

Was this web page useful to you?

Thank You!

The Tax Basis works exhausting to offer insightful tax coverage evaluation. Our work will depend on assist from members of the general public such as you. Would you contemplate contributing to our work?

Contribute to the Tax Foundation

Tell us how we will higher serve you!

We work exhausting to make our evaluation as helpful as potential. Would you contemplate telling us extra about how we will do higher?