As the truth of a second quarter of unfavorable financial progress settles in Washington, the Congressional Price range Workplace (CBO) released its own sobering report on the federal government’s long-term funds. The CBO long-term finances outlook report exhibits widening deficits over the subsequent three a long time as each federal spending and tax revenues are anticipated to rise above historic ranges, with spending progress far outpacing the modest progress in tax revenues. Certainly, the Congressional Price range Workplace (CBO) expects federal spending to succeed in 30 p.c of GDP by 2052, a stage most related to European nations.

These projections ought to give lawmakers pause as they think about creating costly new applications to subsidize the semiconductor trade, broaden health-care advantages, and fund new applications to handle local weather change. The CBO expects that even with the expiration of a lot of the Tax Cuts and Jobs Act (TCJA) in 2026 and vital new revenues generated by actual bracket creep, the gulf between tax revenues and outlays will attain over 10 p.c of GDP by 2052.

In the meantime, the $280 billion in new spending and tax subsidies Congress simply licensed within the Chips and Science Act will almost cancel out the reported $300 billion in deficit discount that supporters say will likely be delivered by the Inflation Discount Act. And this doesn’t think about the hurt that the tax will increase will do to the recessionary financial system. Because of this, the mixture of each items of laws will make the long-term fiscal image even worse.

Remark #1: The hole between spending and taxes is rising, whilst each are anticipated to rise above historic averages. Spending is the issue.

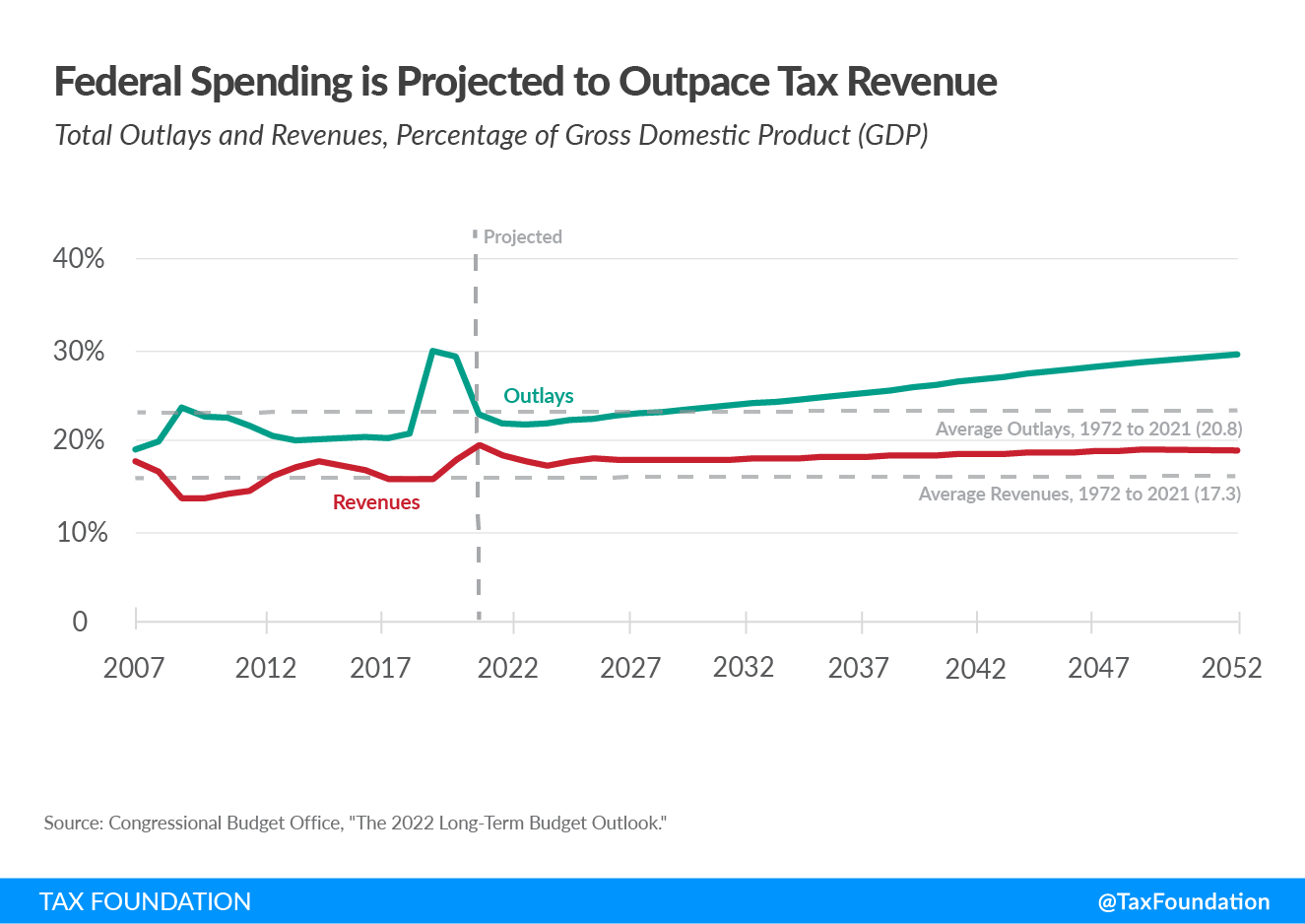

Because the under chart illustrates, over the previous roughly 50 years, 1972 to 2021, the hole between federal spending and tax revenues has averaged 3.5 p.c of GDP. Spending has averaged 20.8 p.c of GDP, whereas revenues averaged 17.3. At the moment, the hole stands at 3.9 p.c of GDP with spending nicely above historic averages at 23.5 p.c of GDP and revenues at a near-record 19.6 p.c of GDP.

Whereas the CBO is projecting at greatest modest progress in tax revenues over the subsequent three a long time, it’s projecting an virtually linear progress in spending that may attain 30 p.c of GDP by 2052. The three largest drivers: web curiosity funds on the nationwide debt, main health-care applications reminiscent of Medicare, and Social Safety.

At the moment, curiosity funds on the nationwide debt stand at 1.6 p.c of GDP. However CBO tasks these funds to rise greater than threefold to 7.2 p.c of GDP by 2052. Thus, curiosity funds on the debt would ultimately represent a bigger share of GDP than both Medicare or Social Safety. The CBO’s estimate may very well be conservative if rates of interest are increased in the long term than at present predicted.

Federal health-care applications are a serious driver of future deficit spending. In the present day, these prices comprise 5.8 p.c of GDP (greater than Social Safety) however are projected to succeed in 8.8 p.c by 2052. Social Safety, which now stands at 4.9 p.c of GDP, is predicted to develop to six.4 p.c over the subsequent 30 years.

Against this, discretionary spending—the whole lot from nationwide protection to transportation to schooling funding—is predicted to complete 6.0 p.c of GDP. So by 2052, the federal authorities’s major features will likely be offering well being care and retirement advantages to People, and paying for previous money owed, not core features like nationwide safety.

Remark #2: Actual bracket creep and TCJA expiration will increase revenues modestly as a p.c of GDP—however not almost sufficient to maintain up with rampant spending.

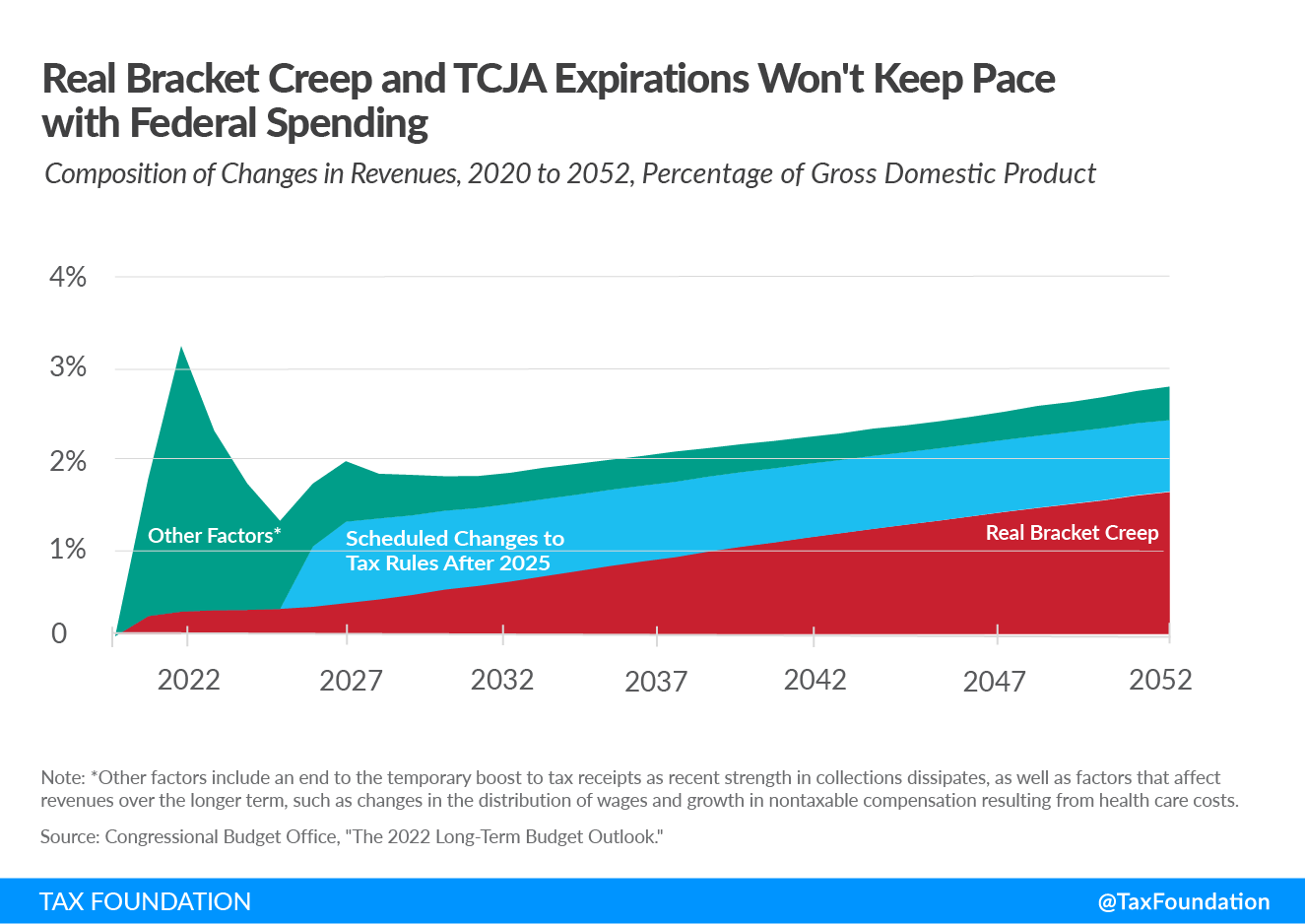

One of many largest surprises contemplating the present state of the financial system is that federal tax revenues are at a near-record stage of 19.6 p.c of GDP. The one different 12 months during which revenues took extra of the nation’s revenue was 2000, the 12 months of the tech bubble in monetary markets. Regardless of at the moment’s surge in tax collections, the CBO is anticipating tax revenues to dip again to their historic common stage in 2025 (17.6 p.c)—simply earlier than the foremost elements of the Tax Cuts and Jobs Act (TCJA) are scheduled to run out—then step by step climbing once more, reaching 19.1 p.c of GDP by 2052.

The revenues generated by TCJA’s expiration—which primarily impacts the person elements of the plan—are a major consider preserving future income ranges above historic norms. Certainly, the CBO estimates that TCJA’s expiration quantities to a tax enhance of about 0.8 p.c of GDP by means of 2052.

Apparently, a extra vital issue contributing to future will increase in tax revenues, in accordance with the CBO, is actual bracket creep. Whereas a lot of the tax code, together with tax brackets, are listed to the speed of value inflation, historical past signifies that wages and salaries rise sooner than costs. So though the CBO is projecting that actual earnings per employee will develop at roughly 1 p.c per 12 months over the subsequent 30 years, this is sufficient to push tax revenues up as a share of the financial system. The impact is gradual, beginning at 0.3 p.c of GDP, however reaches 1.6 p.c by 2052.

The under desk illustrates how actual bracket creep can enhance the quantity of revenue taxed at increased charges whereas shrinking the quantity taxed at decrease charges. For instance, the CBO estimates that in 2032, some 9 p.c of taxable revenue will likely be taxed on the highest marginal tax charge of 39.6 p.c (the highest charge after TCJA expiration). Nonetheless, due to actual bracket creep, they venture that 11 p.c of revenue will likely be taxed on the highest charge 20 years later.

Equally, a large variety of lower-to-middle-income taxpayers will likely be paying increased taxes due to actual bracket creep. We are able to see that the share of revenue taxed within the zero bracket and the share taxed within the 10 to fifteen p.c brackets each decline between 2032 and 2052 whereas the share taxed within the 20 to 35 p.c brackets will increase. This illustrates how actual wage progress can elevate taxpayers into increased brackets, quietly boosting federal coffers.

| Revenue Tax Price | ||||

|---|---|---|---|---|

| 0 | 10 to fifteen % | 20 to 35 % | 39.6 % | |

| 2032 | 26% | 37% | 29% | 9% |

| 2052 | 23% | 33% | 33% | 11% |

|

Supply: Congressional Price range Workplace, “The 2022 Lengthy-Time period Price range Outlook,” Determine 2-8. |

||||

Remark #3: Congress seems to be worsening the deficit image with the Chips and Science Act and the Inflation Discount Act.

In the meantime, Congress simply handed the Chips and Science Act which authorizes some $280 billion in new direct subsidies and tax credit for the semiconductor trade and associated applications. Some $79 billion of that is for subsidies and tax credit between 2023 and 2027. The remaining $200 billion is allowed primarily for analysis functions between 2022 and 2031.

Whereas touted as strengthening the home manufacturing of laptop chips and rising nationwide safety, the invoice creates a brand new “chip” forms and a brand new particular curiosity depending on taxpayer subsidies.

Though the invoice’s $79 billion in subsidies and tax credit are licensed by means of 2027, Congress is liable to extending well-liked measures, which might doubtless double the price of these initiatives over 10 years.

Subsequent, the Senate is poised to debate the Inflation Discount Act, which accommodates some $433 billion in new spending over the subsequent decade: $369 billion for “vitality safety and local weather change,” and $64 billion for extending Reasonably priced Care Act (ACA) subsidies for 3 years.

These new spending measures are mentioned to be offset by $739 billion in new revenues: $313 billion by enacting a brand new 15 p.c minimal tax on company ebook revenue; $288 billion by permitting Medicare to barter prescription drug costs; $124 billion by giving the IRS extra money to audit high-income taxpayers; and, $14 billion by closing the so-called carried curiosity loophole.

These are static estimates, nonetheless, and haven’t been adjusted to account for his or her potential impression on slowing financial progress, doubtless overshooting how a lot the invoice will elevate in new revenues.

Nonetheless, ought to the brand new revenues materialize as claimed, the invoice is meant to ship $300 billion in deficit discount over the subsequent decade. However almost all of this deficit discount will likely be offset by the $280 billion simply licensed for the Chips and Science Act. The web impact on future deficits will likely be immaterial at greatest. Nonetheless, if we assume that the ACA subsidies are also prolonged for a full 10 years, the mixed laws will certainly worsen the long-term fiscal image.

Conclusion

The newest CBO long-term finances outlook paints a troubling image of fiscal irresponsibility. Even assuming that tax revenues stay above historic norms the subsequent three a long time, future deficits are projected to develop quickly due to the unconstrained progress of health-care applications, Social Safety, and funds on the exploding nationwide debt. Somewhat than halt this rampant spending, Congress is actively including applications that may exacerbate these long-term developments. What we want is a critical dose of fiscal sobriety, not a brand new spending binge.