Because the Senate weighs adjustments to the spending and tax parts of the Construct Again Higher Act, the Congressional Budget Office (CBO) and Tax Basis discover the invoice would improve the cumulative price range deficit over the subsequent 10 years—opposite to claims the laws is “absolutely paid for.” The deficit impression might contribute to short-run inflation and can grow if the momentary insurance policies are prolonged and the price range gimmicks used to attenuate the potential long-run value of the laws are eliminated.

Over 10 years, the CBO estimates the Construct Again Higher Act (BBBA) would improve federal spending and tax credit (and different cuts in taxes) by $2.15 trillion whereas producing $1.98 trillion in offsets (income raisers and cuts in spending), making a $159 billion price range deficit. Tax Basis finds an identical quantity of spending and tax credit within the invoice however finds the offsets would improve federal income by about $1.67 trillion, producing a bigger, $470 billion deficit between 2022 and 2031.

| Congressional Funds Workplace | Tax Basis | |

|---|---|---|

| Spending & Tax Credit | $2.15 trillion | $2.14 trillion |

| Income Raisers/Offsets | $1.98 trillion | $1.67 trillion |

| Typical Deficit (earlier than curiosity prices) | $159 billion | $470 billion |

|

Word: SALT deduction cap adjustments are included as a internet income raiser, slightly than splitting the results between income raised and a tax reduce. Estimates embrace the income impression of elevated Inner Income Service (IRS) enforcement sources. Supply: Congressional Funds Workplace, Committee for a Responsible Federal Budget, Tax Basis Common Equilibrium Mannequin, November 2021. |

||

The deficit estimates assume the laws’s spending and tax credit, such because the expanded youngster tax credit score (CTC), expire as scheduled within the invoice. The expanded CTC provisions alone would value about $1.6 trillion over 10 years if made everlasting. If the laws’s different momentary tax credit and spending packages are additionally made everlasting, the associated fee would roughly double to about $5 trillion and add $3 trillion to the nationwide debt over 10 years, in accordance with the CBO. The dearth of steady funding required to increase the brand new packages creates uncertainty for taxpayers and beneficiaries as they could not be capable to depend on the packages going ahead, or new taxes will have to be levied.

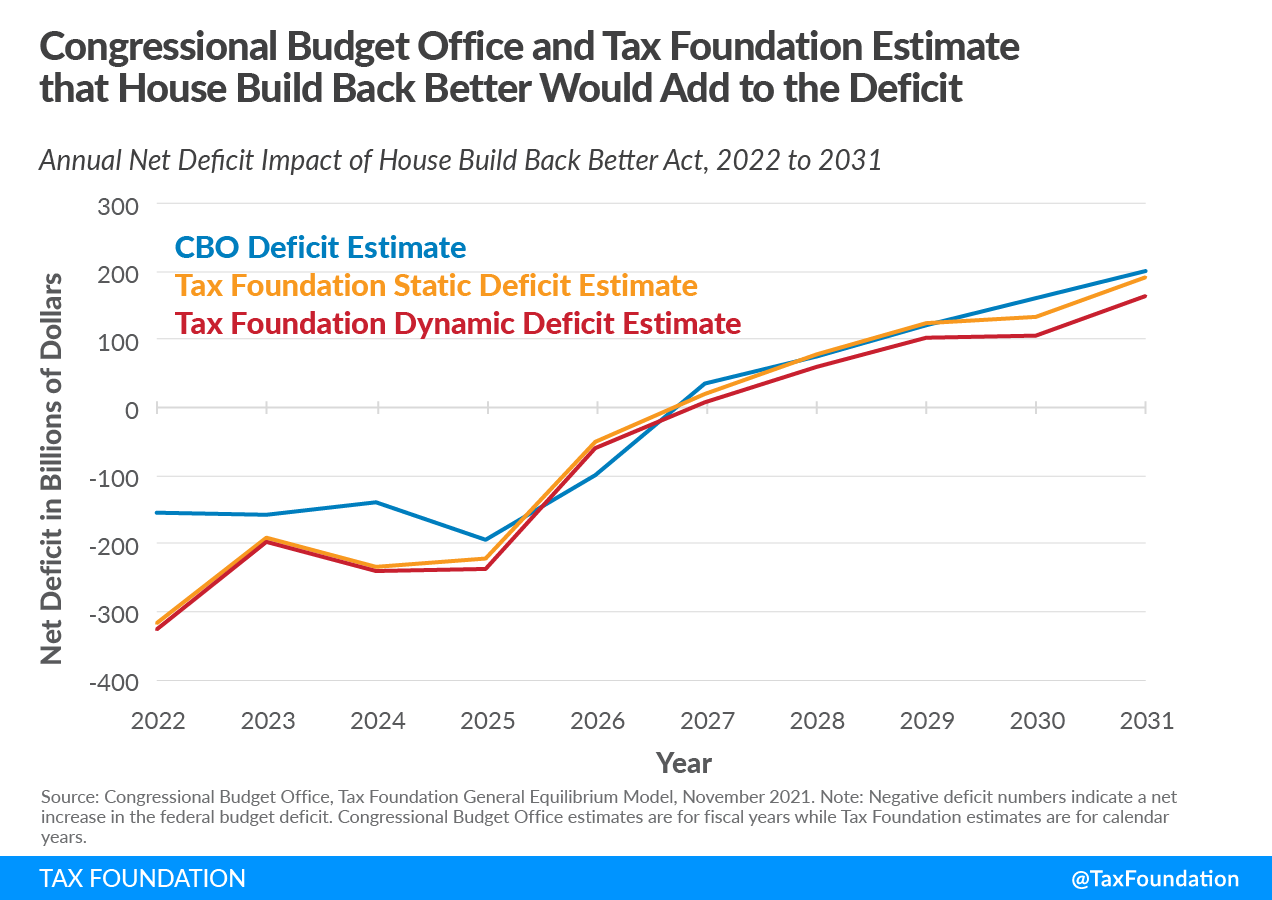

The laws would add to the federal deficit between 2022 and 2026, which is pushed by bigger upfront spending and tax cuts whereas many offsets are simply phasing in. CBO estimates the deficit would improve by $749 billion over the primary 5 years, whereas Tax Basis estimates it could exceed $1 trillion. A brief-term deficit might contribute to increased inflation, particularly as a result of the invoice might improve the deficit in 2022 by upwards of $318 billion, in accordance with Tax Basis estimates.

Between 2027 and 2031, the invoice reduces federal deficits by $589 billion in accordance with the CBO and $548 billion in accordance with Tax Basis. The deficit discount during the last 5 years, nonetheless, just isn’t sufficient to cowl the deficit improve over the laws’s first 5 years.

The deficit estimates from the CBO and Tax Basis have three main variations. First, the CBO presents the deficit impression for each fiscal year, which runs from October 1st to September 30th. Tax Basis produces estimates utilizing calendar years, working from January 1st to December 31st. The timing distinction is essential as a result of the laws would begin to take impact January 1, 2022, so our calendar yr outcome for 2022 (a deficit of $318 billion) captures your entire first yr impact whereas the CBO’s fiscal yr 2022 outcome captures solely the primary 9 months of the BBBA.

Second, the CBO depends on income estimates for tax provisions from the Joint Committee on Taxation (JCT), which differs in some circumstances from Tax Basis estimates. For instance, the JCT estimates the proposed 15 p.c minimal tax on company e-book earnings would increase $319 billion over 10 (fiscal) years, whereas Tax Basis estimates it could increase $204 billion over 10 (calendar) years—a distinction not solely defined by fiscal/calendar yr variations.

The JCT estimates the 1 p.c excise tax on inventory buybacks would increase $124 billion, whereas Tax Basis locations it nearer to $62 billion. The JCT finds the proposed surcharge on earnings earned over $10 million would increase $252 billion, and Tax Basis finds it could increase $186 billion. The 2 main pass-through enterprise tax proposals increase $422 billion in accordance with the JCT, whereas Tax Basis finds they might increase about $317 billion.

The variations in income estimates could also be largely on account of differing forecasts for the tax bases, e.g., objects like the amount of company inventory buybacks. If future financial exercise diverges from historic traits, this may have a big impression on precise revenues. For instance, company inventory buybacks might proceed their upward trajectory since 2018, or they could revert to longer-run historic ranges, which is what we assume. The next stage of inventory buybacks sooner or later might indicate increased anticipated income from the proposed 1 p.c excise tax.

Lastly, Tax Basis produces deficit estimates on each a standard and a dynamic foundation. A traditional deficit estimate holds the scale of the economic system fixed, setting apart the impression of income raisers on financial exercise reminiscent of funding and wages. A dynamic estimate incorporates the impression of tax adjustments on the economic system, which can lower the quantity of income anticipated from sure tax will increase.

Tax Basis finds the adverse financial impression of the proposed tax will increase on people and companies will increase the cumulative deficit by about $155 billion over 10 years, totaling $624 billion earlier than curiosity prices. Together with curiosity prices, the cumulative deficit totals $838 billion over 10 years.

Was this web page useful to you?

Thank You!

The Tax Basis works laborious to offer insightful tax coverage evaluation. Our work will depend on help from members of the general public such as you. Would you take into account contributing to our work?

Contribute to the Tax Foundation

Tell us how we are able to higher serve you!

We work laborious to make our evaluation as helpful as potential. Would you take into account telling us extra about how we are able to do higher?