“Frothy eloquence neither convinces nor satisfies me,” the nineteenth century Congressman Willard Duncan Vandiver allegedly declared. “I’m from Missouri. You’ve got to indicate me.”

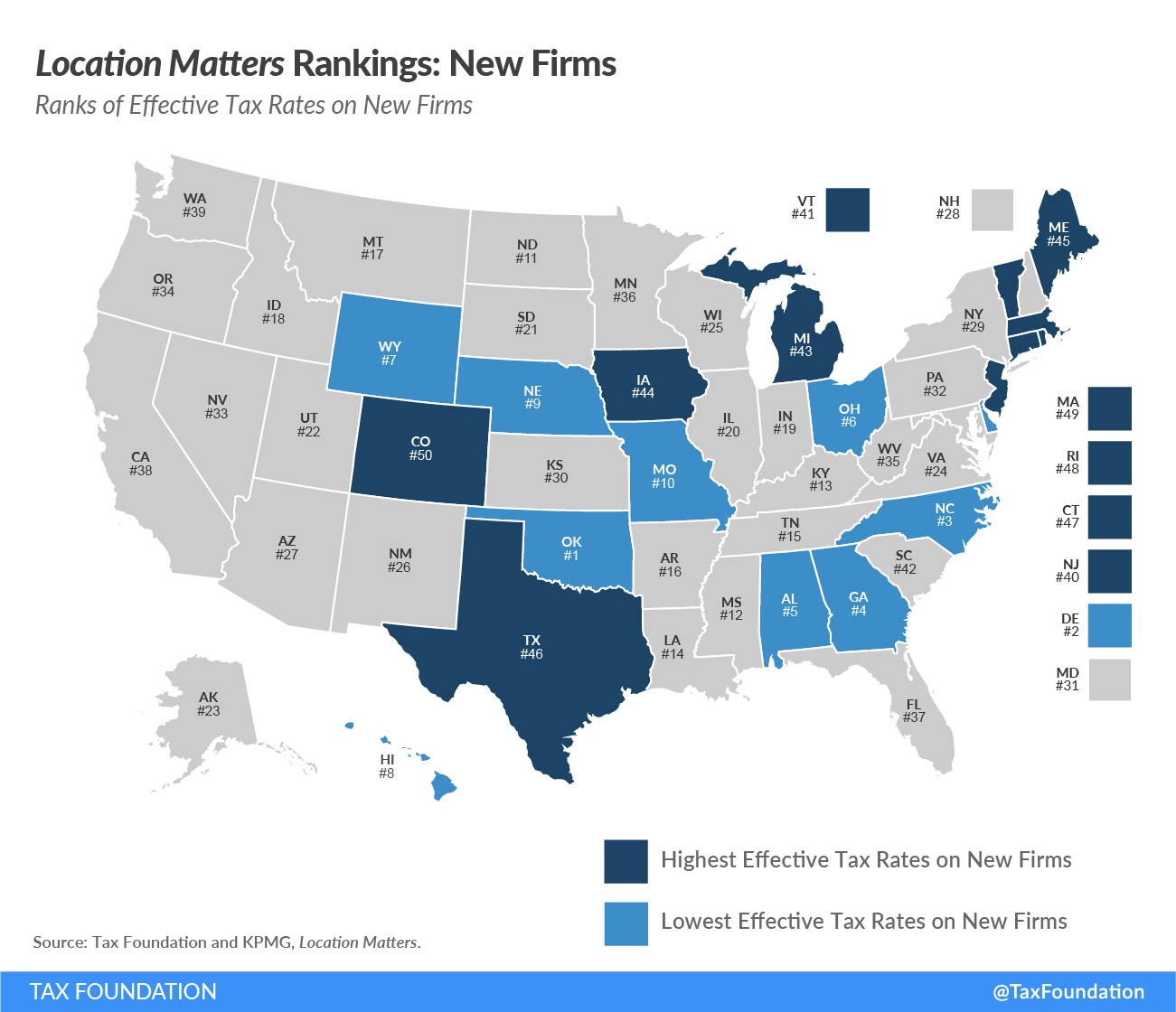

Within the realm of tax coverage and financial competitiveness, lawmakers from the Present-Me state are turning the previous adage round. They’re displaying the remainder of the nation find out how to create a extra aggressive tax code—one which now provides the tenth-lowest efficient charges for brand new companies, based on a brand new evaluation carried out by the Tax Basis and KPMG LLP.[1]

As a state, Missouri has not at all times marched consistent with its friends on tax coverage. It was the final state to undertake financial nexus requirements for its gross sales tax within the wake of the South Dakota v. Wayfair resolution, and it’s one in all a dwindling variety of states to nonetheless provide a deduction for federal taxes paid. However when Missouri has acted, it has accomplished so decisively, and ceaselessly in ways in which have benefited taxpayers. When the state did undertake a post-Wayfair distant gross sales tax regime, it took the chance—uncared for nearly all over the place else—to make use of the extra income to pay down earnings tax charge reductions, for example.

Extra ones, actually, for the reason that state had already launched into earlier efforts to deliver down charges and improve its tax competitiveness, together with reforms yielding a extremely aggressive 4 % company earnings tax charge with apportionment guidelines that favor in-state funding. And for pass-through companies, which pay by the person earnings tax code, laws adopted in 2014, 2018, and 2021 will finally drop the highest particular person earnings tax charge to 4.8 %, from a place to begin of 6 %.[2]

All that is excellent news for companies and people in Missouri. Whereas work stays to be accomplished, the progress is obvious, because the Tax Basis’s Location Issues examine reveals.

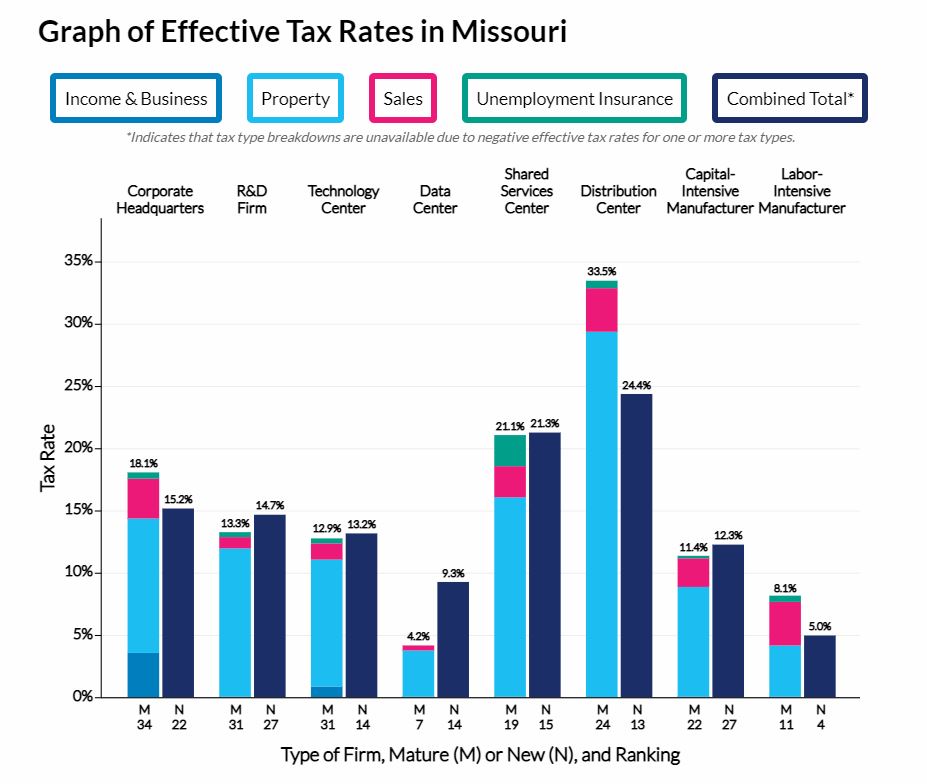

Location Issues compares company tax prices in all 50 states throughout eight mannequin companies: a company headquarters, a analysis and growth facility, a know-how heart, a knowledge heart, a shared companies heart, a distribution heart, a capital-intensive producer, and a labor-intensive producer. Every agency is modeled twice, first as a brand new operation eligible for tax incentives after which as a mature operation not eligible for such incentives.

Missouri provides notably engaging tax charges to knowledge facilities, shared companies facilities, and labor-intensive producers, in addition to newly established know-how facilities, because of sure elements of the state’s tax construction. Whereas most different companies expertise extra middle-of-the-pack burdens, Missouri is notable for avoiding disproportionately excessive taxes on any of the industries we studied. No mature agency is ranked worse than thirty fourth, and no new operation worse than twenty seventh. Consequently, the state ranks tenth total for brand new operations and 18th for mature companies.

| Rank | ||

|---|---|---|

| State | New | Mature |

| Missouri | 10 | 18 |

| Arkansas | 16 | 33 |

| Illinois | 20 | 46 |

| Iowa | 44 | 42 |

| Kansas | 30 | 50 |

| Kentucky | 13 | 15 |

| Nebraska | 9 | 9 |

| Oklahoma | 1 | 10 |

| Tennessee | 15 | 8 |

|

Supply: Tax Basis, Location Issues. |

||

Two neighboring states—Nebraska and Oklahoma—present extra aggressive total tax charges to newly established companies, whereas 4 of Missouri’s eight border states—Kentucky, Nebraska, Oklahoma, and Tennessee—outperform Missouri in charges on mature companies.

Missouri sources companies the place the advantages are obtained, which is to the benefit of companies like shared companies facilities, and the state exempts manufacturing equipment from the gross sales tax, which lowers tax prices for each capital- and labor-intensive manufacturing firms. For a lot of companies, notably these with gross sales largely out of state, earnings tax burdens are negligible. Property taxes might be substantial for some companies, nonetheless, and the state gross sales tax charge is above-average, which offsets a number of the profit supplied by modest earnings taxes. Nevertheless, native jurisdictions have the flexibility to abate property taxes for sure aggressive investments. And in lots of instances, each state and native entities may also exempt gross sales taxes by numerous incentive packages.

Notably, Missouri has break up roll property taxation, that means that business property faces increased efficient charges than equally valued residential property. Enterprise equipment and tools can be topic to property taxes, although, like most states, Missouri exempts stock. Whereas unusual, stock taxation is practiced by three of Missouri’s neighbors (Arkansas, Kentucky, and Oklahoma).

| Earnings & Enterprise Taxes | Property Taxes | Gross sales Taxes | UI Taxes | Complete Efficient Tax Fee | Rank | |

|---|---|---|---|---|---|---|

| Company Headquarters | ||||||

| Mature | 3.6% | 10.8% | 3.2% | 0.5% | 18.1% | 34 |

| New | -2.2% | 12.4% | 4.5% | 0.5% | 15.2% | 22 |

| Analysis & Improvement | ||||||

| Mature | 0.1% | 11.9% | 0.9% | 0.4% | 13.3% | 31 |

| New | -4.0% | 16.7% | 1.4% | 0.5% | 14.7% | 27 |

| Expertise Middle | ||||||

| Mature | 0.9% | 10.2% | 1.3% | 0.4% | 12.9% | 31 |

| New | -8.5% | 16.1% | 5.1% | 0.6% | 13.2% | 14 |

| Information Middle | ||||||

| Mature | 0.1% | 3.7% | 0.4% | 0.0% | 4.2% | 7 |

| New | -0.2% | 8.3% | 1.1% | 0.0% | 9.3% | 14 |

| Shared Providers Middle | ||||||

| Mature | 0.1% | 16.0% | 2.5% | 2.5% | 21.1% | 19 |

| New | -7.7% | 20.8% | 5.0% | 3.1% | 21.3% | 15 |

| Distribution Middle | ||||||

| Mature | 0.0% | 29.4% | 3.5% | 0.6% | 33.5% | 24 |

| New | -1.9% | 19.0% | 6.5% | 0.7% | 24.4% | 13 |

| Capital-Intensive Producer | ||||||

| Mature | 0.1% | 8.8% | 2.3% | 0.2% | 11.4% | 22 |

| New | -1.4% | 10.6% | 2.8% | 0.2% | 12.3% | 27 |

| Labor-Intensive Producer | ||||||

| Mature | 0.1% | 4.1% | 3.5% | 0.5% | 8.1% | 11 |

| New | -5.1% | 5.0% | 4.5% | 0.6% | 5.0% | 4 |

|

Supply: Tax Basis, Location Issues. |

||||||

Whereas in some states, enterprise homeowners have motive to concern that tax burdens will enhance, Missouri has demonstrated a dedication to tax reform in recent times, with extra tax reduction persevering with to section in. Most companies—in addition to people—can count on an more and more aggressive tax atmosphere within the coming years.

In 2014, lawmakers applied cautious income triggers which, if met, would section down the highest particular person earnings tax charge, in 0.1 share level increments, from 6 to five.5 %. In 2018, after the primary phasedown to five.9 %, lawmakers accelerated the method utilizing income from base broadening as a result of federal Tax Cuts and Jobs Act, the definitions from which flowed by to state taxes. On the time, lawmakers applied the 5.5 % charge however left the remaining triggers in place, holding out the prospect of bringing the speed as little as 5.1 %. Whereas many different states had been content material to maintain income windfalls from federal tax reform, Missouri lawmakers returned it to taxpayers.[3]

In 2021, with revenues persevering with to tick upward regardless of the worldwide pandemic, and with extra income anticipated from the state’s growth of gross sales tax nexus to distant sellers, lawmakers additional revised their targets, extending and revising income triggers to finally drop the person earnings tax charge to 4.8 %. Again and again, Missouri policymakers have acted to return a minimum of a portion of anticipated income development to the taxpayers—notably the place the person earnings tax is worried, which is of appreciable curiosity to the 96 % of Missouri companies that are structured as S firms, partnerships, restricted legal responsibility firms, or sole proprietorships, and thus file by the person earnings tax code.[4]

Conventional C firms haven’t, nonetheless, been uncared for. In 2018, the legislature lower the company earnings tax charge from a middle-of-the-pack 6.25 % to a extremely aggressive 4 %, which is at the moment tied for second lowest within the nation, with Oklahoma. (North Carolina, at 2.5 %, has the lowest-rate company earnings tax of states imposing one.) The speed discount was paid for with structural reforms, specifically repealing an anachronistic coverage of federal deductibility whereas requiring using a uniform apportionment issue.

Underneath federal deductibility—now repealed for company taxpayers and curtailed, however not eradicated, for particular person filers—taxpayers may deduct their federal tax legal responsibility from state taxable earnings. This was a approach of lowering state tax legal responsibility, however one far inferior to a decrease charge, as a result of it tied Missouri’s tax code to federal coverage in sudden and infrequently undesirable methods. When federal taxes went down, Missouri taxes went up. When the federal authorities supplied preferential therapy of one thing, Missouri penalized it. So when, for example, the federal authorities improves its therapy of capital funding, or gives a credit score for analysis and growth expenditures, a coverage of federal deductibility yields the inverse therapy on the state degree, growing taxes on these actions.

Changing federal deductibility with decrease charges has improved Missouri’s company tax construction, and the identical might be true for particular person taxpayers if it had been totally repealed throughout the particular person earnings tax as properly. Whereas the person earnings tax doesn’t have an effect on the standard C firms analyzed in Location Issues, it issues to many Missouri employers.

Missouri’s improved tax local weather is mirrored not solely in Location Issues however in different research as properly, together with the Tax Basis’s State Enterprise Tax Local weather Index and CNBC’s “America’s High States for Enterprise” rankings. Since Missouri’s tax reforms started to section in, the state has improved from 18th to tenth on the “Economic system” subcomponent of CNBC’s rankings and from seventeenth to fifth on the price of doing enterprise,[5] whereas enhancing from sixteenth to twelfth total on the State Enterprise Tax Local weather Index, which measures tax construction. Specifically, Missouri now boasts the perfect company tax construction of any state with a company earnings or gross receipts tax, and has the fourth-best total rating amongst states with all the key state-level taxes (particular person earnings tax, company earnings tax, and gross sales tax), after Utah, Indiana, and North Carolina.[6]

Whereas Missouri has room for enchancment, the state is making waves, positioning itself as an more and more engaging location for enterprise funding. And as ongoing reforms additional improve the competitiveness of the state’s tax code, extra companies will take discover.

[1] Jared Walczak et al., Location Issues 2021: The State Tax Prices of Doing Enterprise, Tax Basis, Might 5, 2021, https://www.taxfoundation.org/state-tax-costs-of-doing-business-2021/.

[2] Katherine Loughead and Jared Walczak, “States Reply to Sturdy Fiscal Well being with Earnings Tax Reforms,” Tax Basis, July 15, 2021, https://www.taxfoundation.org/2021-state-income-tax-cuts/.

[3] Jared Walczak, “Missouri Governor Set to Signal Earnings Tax Cuts,” Tax Basis, July 11, 2018, https://www.taxfoundation.org/missouri-governor-set-sign-income-tax-cuts/.

[4] Inside Income Service, “IRS Information E book, 2020,” https://www.irs.gov/statistics/soi-tax-stats-irs-data-book-index-of-tables; and Tax Basis calculations.

[5] CNBC, “America’s High States for Enterprise 2021,” July 13, 2021, https://www.cnbc.com/2021/07/13/americas-top-states-for-business.html (and prior years).

[6] Jared Walczak and Janelle Cammenga, 2021 State Enterprise Tax Local weather Index, Oct. 21, 2020, https://www.taxfoundation.org/2021-state-business-tax-climate-index/.